All 30 Dow Stocks Ranked: The Pros Weigh In

The Dow Jones Industrial Average comprises 30 blue-chip stocks that are tops in their industries. But some Dow stocks are better buys than others.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

You can't beat Dow stocks for stability and defense in a down market. By the same token, the blue chip average won't always keep up in a rising market.

Case in point: equities are off to a strong start in 2023, with the S&P 500 generating a total return (price change plus dividends) of 8.1% through April 20. The tech-heavy Nasdaq Composite, which is both riskier and "growthier," jumped 15.5% on a total return basis over the same span.

The Dow Jones Industrial Average, by comparison, is very much lagging the pack. The elite bastion of 30 mostly mature industry leaders delivered a relatively poky total return of 2.6% through the first 16 weeks of the year.

Zoom out, however, and Dow stocks have served buy-and-hold investors quite well since the market hit its all-time closing peak back on Jan. 3, 2022. The S&P 500's total return stands at -12% since then. The Nasdaq Composite's total return comes to -23% over the same time frame.

True, the Dow has by no means escaped the bear market unscathed. But its total return of -5.1% since the market peaked out has saved plenty of investors from suffering significantly steeper losses.

As bright a start to the year as it's been for equity investors, no shortage of economists and strategists see dark skies ahead. Rising interest rates, sticky inflation, a retreat in lending stemming from the regional bank crisis and a gloomy GDP forecast could very well squelch market participants' appetite for risk as we head into the second half of 2023.

That's where Dow stocks come in.

This collection of industry-leading companies and dividend growth stalwarts with their battleship-like balance sheets can offer something of a safe harbor in tempestuous times. From the best Dow dividend stocks to the most widely held blue chip stocks, components of the industrial average occupy top spots in the portfolios of hedge funds and billionaire investors. Warren Buffett's Berkshire Hathaway (BRK.B (opens in new tab)), in particular, is a huge fan of certain Dow stocks.

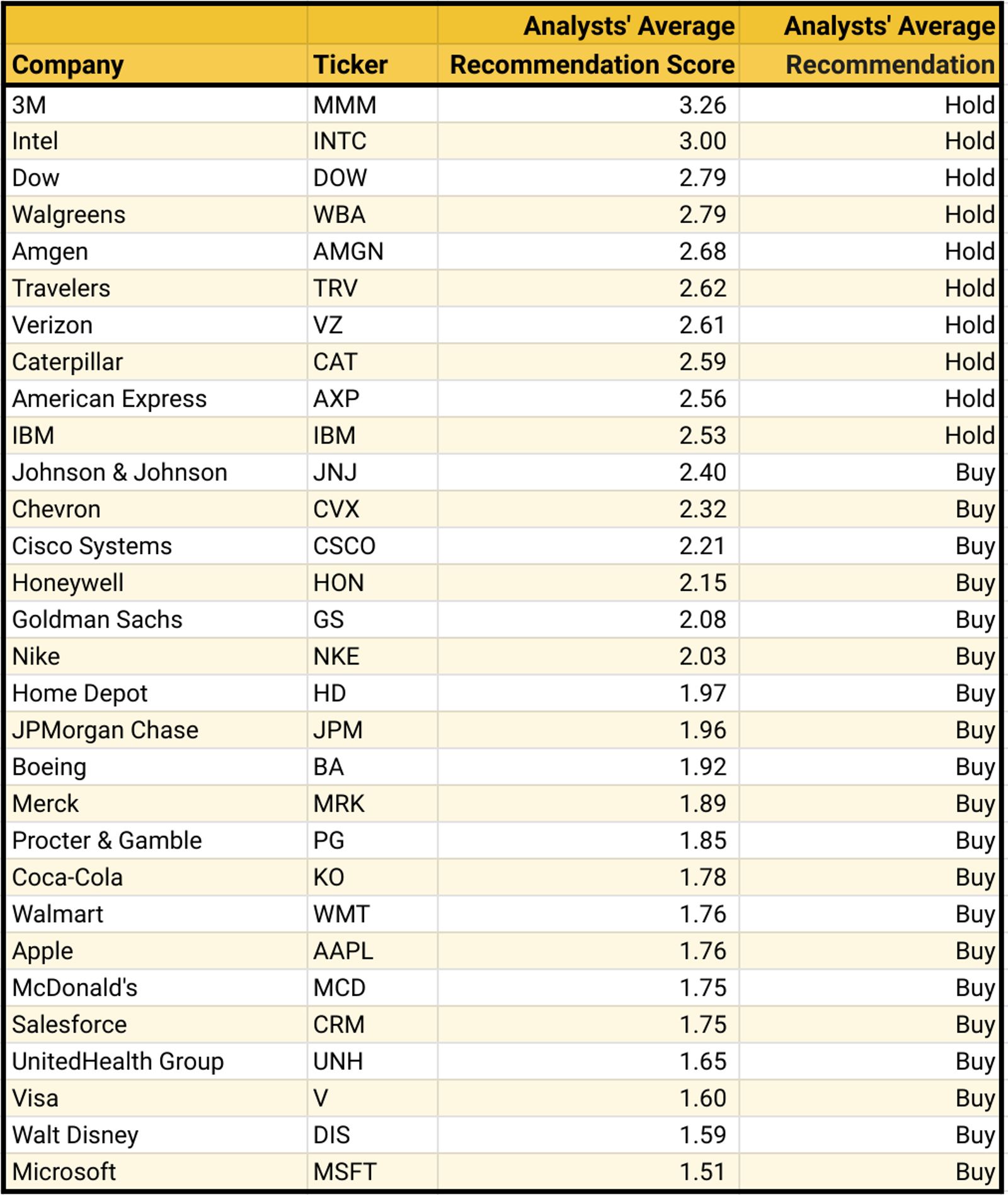

To get a sense of which Dow stocks Wall Street recommends in another uncertain year for equities, we screened the DJIA by analysts' consensus recommendations, from worst to first, using data from S&P Global Market Intelligence (opens in new tab).

Here's how the ratings system works: S&P surveys analysts' stock calls and scores them on a five-point scale, where 1.0 equals a Strong Buy and 5.0 is a Strong Sell. Scores between 3.5 and 2.5 translate into Hold recommendations. Scores higher than 3.5 equate to Sell ratings, while scores equal to or below 2.5 mean that analysts, on average, rate shares at Buy. The closer a score gets to 1.0, the higher conviction the Buy recommendation.

See the table below for analysts' consensus recommendations on all 30 Dow stocks, per S&P Global Market Intelligence, as of April 21, 2023.

Dan Burrows is Kiplinger's senior investing writer, having joined the august publication full time in 2016.

A long-time financial journalist, Dan is a veteran of SmartMoney, MarketWatch, CBS MoneyWatch, InvestorPlace and DailyFinance. He has written for The Wall Street Journal, Bloomberg, Consumer Reports, Senior Executive and Boston magazine, and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among other publications. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange and hosted a weekly video segment on equities.

In his current role at Kiplinger, Dan writes about equities, fixed income, currencies, commodities, funds, macroeconomics, demographics, real estate, cost of living indexes and more.

-

-

To Afford Retirement, Take Inspiration from ‘The Golden Girls’

To Afford Retirement, Take Inspiration from ‘The Golden Girls’Roommates, a part-time job and renting out your vacation home could be ways to save early in retirement to cover more expensive years later on.

By Erin Wood, CFP®, CRPC®, FBSⓇ • Published

-

Why You Should Teach Your Kids Investing

Why You Should Teach Your Kids InvestingPutting money in the stock market is one of the best ways to build wealth in America. That's why it is so important for parents to teach their kids investing.

By Kyle Woodley • Published

-

Stock Market Today: Disney Earnings Drag on Dow

Stock Market Today: Disney Earnings Drag on DowAn unexpected decline in subscribers weighed on Disney stock Thursday, while notable deposit outflows sent PacWest tumbling.

By Karee Venema • Published

-

Disney Stock Tumbles: Time to Buy?

Disney Stock Tumbles: Time to Buy?Analysts say Disney stock is a buy on weakness after shares sell off on a subscriber miss.

By Dan Burrows • Last updated

-

Stock Market Today: Apple Earnings, Bank Stocks Spark Relief Rally

Stock Market Today: Apple Earnings, Bank Stocks Spark Relief RallyThe April jobs report creates uncertainty around the Fed's future policy plans, but it didn't stop the major indexes from soaring Friday.

By Karee Venema • Published

-

Apple Stock Remains a Strong Buy Even as Shares Soar

Apple Stock Remains a Strong Buy Even as Shares SoarApple stock has added more than $680 billion in value this year and it still has more room to run, analysts say.

By Dan Burrows • Published

-

Stock Market Today: Stocks Slide as Regional Bank Rout Worsens

Stock Market Today: Stocks Slide as Regional Bank Rout WorsensThe major market indexes closed lower Thursday as chaos in the banking industry continued.

By Karee Venema • Published

-

Johnson & Johnson Spins Off Kenvue in Biggest IPO Haul Since 2021

Johnson & Johnson Spins Off Kenvue in Biggest IPO Haul Since 2021Johnson & Johnson rips off Band-Aid and spits out Listerine in a bid to boost margins.

By Dan Burrows • Published

-

The Richest Person in the World Revealed

The Richest Person in the World RevealedThe richest person in the world might surprise you — as they beat Elon Musk and Bill Gates to the top spot.

By Vaishali Varu • Published

-

Advanced Micro Devices Stock Sinks as PC Chip Sales Slump

Advanced Micro Devices Stock Sinks as PC Chip Sales SlumpAdvanced Micro Devices stock is trading lower Wednesday after the chipmaker's Q1 earnings, but most analysts are still bullish on the name.

By Karee Venema • Published