Best Blue Chip Stocks: 21 Hedge Fund Top Picks

What is the reputed smart money up to lately? Here are the 21 most popular blue chip stocks among the hedge fund crowd.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

Thanks in part to their massive market caps and deep liquidity, blue chip stocks are a natural home for hedge funds and other large pools of institutional capital.

Of course, not all blue chip stocks are created equal. And hedge funds, as a group, actually have a rather poor long-term track record vs. the broader market.

Still, there's something irresistible about knowing what the putative smart money has been up to. Besides, you've got to give hedge funds credit where credit is due.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Hedging strategies by definition limit upside when stocks are rising, which helps explain the industry's years of underperformance during the last bull market. By the same token, however, hedging strategies limit downside when everything is selling off. And goodness knows investors have seen plenty of red on their screens recently.

Consider 2022, when hedge funds earned their keep during a truly dismal year for equities. The Eurekahedge (opens in new tab) Hedge Fund Index delivered a total return (price appreciation plus dividends) of -4.8% last year. The S&P 500, meanwhile, generated a total return of -18.1%.

In other words, in the worst year for U.S. stocks since the Great Financial Crisis, hedge funds beat the broader market by almost 14 percentage points.

We won't know how hedge funds are dealing with the current market selloff until they disclose their first-quarter buys and sells in mid-May. But we do know what they were up to in Q4, thanks to a recent batch of regulatory filings.

It turns out that much of what they were up to involved the large-scale dumping of the market's biggest and best-known blue chip stocks. "Funds played defense in 2022," notes Goldman Sachs strategist Ben Snider.

Be that as it may, hedge funds, as always, remain heavily invested in most of the market's biggest and bluest of blue chip stocks – particularly Dow stocks.

That's partly a function of Dow stocks' massive market capitalizations and attendant liquidity, which, as noted above, creates ample room for institutional investors to build or pare large positions.

Big-name blue chip stocks also carry a lower level of reputational risk for professional money managers. (It's a lot easier to justify holding a large position in a Dow stock than a no-name small-cap if restive clients start grumbling about their returns.)

It also happens to be the case that almost half these names are not in the famed blue chip barometer. A few of these picks might even surprise you.

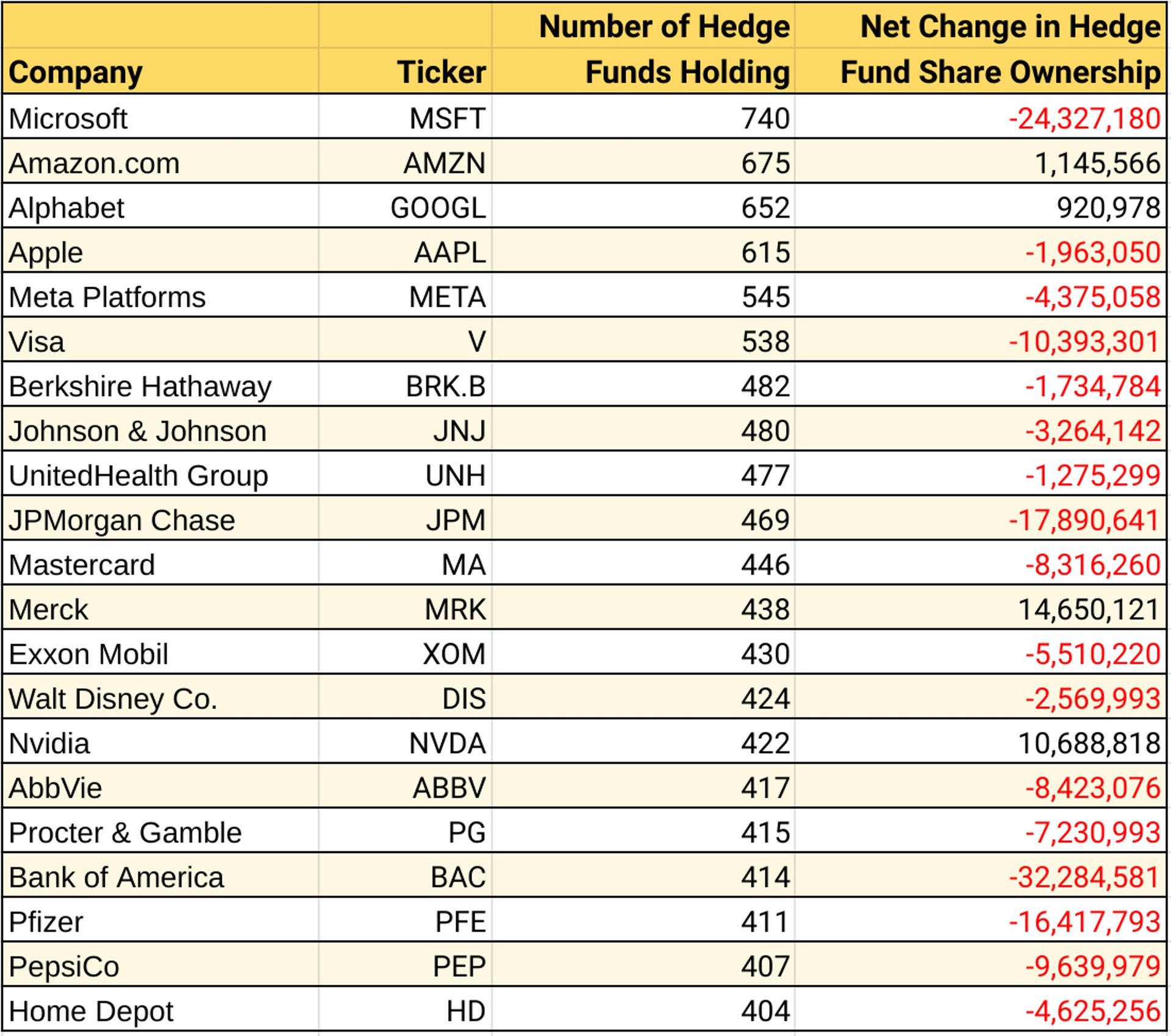

Have a look at hedge funds 21 top blue chip stock picks as of Dec. 30, 2022 in the chart below. Note that defense did indeed prevail in Q4. Only four names saw a positive net change in share ownership by hedge funds.

Dan Burrows is Kiplinger's senior investing writer, having joined the august publication full time in 2016.

A long-time financial journalist, Dan is a veteran of SmartMoney, MarketWatch, CBS MoneyWatch, InvestorPlace and DailyFinance. He has written for The Wall Street Journal, Bloomberg, Consumer Reports, Senior Executive and Boston magazine, and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among other publications. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange and hosted a weekly video segment on equities.

In his current role at Kiplinger, Dan writes about equities, fixed income, currencies, commodities, funds, macroeconomics, demographics, real estate, cost of living indexes and more.

-

-

To Afford Retirement, Take Inspiration from ‘The Golden Girls’

To Afford Retirement, Take Inspiration from ‘The Golden Girls’Roommates, a part-time job and renting out your vacation home could be ways to save early in retirement to cover more expensive years later on.

By Erin Wood, CFP®, CRPC®, FBSⓇ • Published

-

Why You Should Teach Your Kids Investing

Why You Should Teach Your Kids InvestingPutting money in the stock market is one of the best ways to build wealth in America. That's why it is so important for parents to teach their kids investing.

By Kyle Woodley • Published

-

Stock Market Today: Stocks Slip as Consumer Sentiment Slides

Stock Market Today: Stocks Slip as Consumer Sentiment SlidesConcerns about the debt ceiling also weighed on stocks Friday.

By Karee Venema • Published

-

Stock Market Today: Disney Earnings Drag on Dow

Stock Market Today: Disney Earnings Drag on DowAn unexpected decline in subscribers weighed on Disney stock Thursday, while notable deposit outflows sent PacWest tumbling.

By Karee Venema • Published

-

Stock Market Today: Stocks Lose Steam After CPI Report

Stock Market Today: Stocks Lose Steam After CPI ReportStocks wavered after the April CPI report supported the case for the Fed to stop raising rates – but not cut them.

By Dan Burrows • Published

-

Stock Market Today: Stocks Churn Ahead of April CPI Report

Stock Market Today: Stocks Churn Ahead of April CPI ReportThe major market indexes made modest moves Tuesday as investors awaited debt-ceiling updates and inflation data.

By Karee Venema • Published

-

Stock Market Today: Stocks Choppy With Inflation Data on Deck

Stock Market Today: Stocks Choppy With Inflation Data on DeckThe major indexes struggled for direction Monday amid more volatility in regional bank stocks and ahead of this week's key inflation updates.

By Karee Venema • Published

-

Warren Buffett's Berkshire Hathaway Stock Is Taking Off

Warren Buffett's Berkshire Hathaway Stock Is Taking OffBerkshire Hathaway stock has been clobbering the broader market since the banking crisis set in.

By Dan Burrows • Published

-

Stock Market Today: Apple Earnings, Bank Stocks Spark Relief Rally

Stock Market Today: Apple Earnings, Bank Stocks Spark Relief RallyThe April jobs report creates uncertainty around the Fed's future policy plans, but it didn't stop the major indexes from soaring Friday.

By Karee Venema • Published

-

Stock Market Today: Stocks Slide as Regional Bank Rout Worsens

Stock Market Today: Stocks Slide as Regional Bank Rout WorsensThe major market indexes closed lower Thursday as chaos in the banking industry continued.

By Karee Venema • Published