What is ESG?

ESG means investing in a way that considers a company’s environmental, social, and governance profile. But will ESG help you meet your investment goals and deliver impact?

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

ESG is a tool that seeks to expand upon a traditional analysis of corporate value by including environmental, social and governance metrics. This approach recognizes that ESG factors, though labeled “non-financial” in traditional accounting terms, may still be critical to a company’s bottom line.

Want Cheap Stocks? Look to the UK. (opens in new tab)

Almost twenty years ago, investors found that companies with better management of ESG factors tended to match or outperform (opens in new tab) their peers, especially over the long term. In other words, companies that anticipated market stressors or opportunities related to sustainability—such as growing water scarcity—would be better positioned to thrive in that future environment. Since then, ESG investing has blossomed into a multi-trillion-dollar industry that relies on many different approaches.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

What Does ESG Mean?

ESG investing breaks these risks and opportunities into environmental, social, and governance metrics. What does that mean in practice?

- Environmental. An environmental analysis of a company will assess how big an impact the company makes on the environment and how well it manages that impact. A beverage company, for instance, may get extra scrutiny because its business is water-intensive, but it can win points if it manages its water usage efficiently. A mining or industrial company’s environment score matters more overall than that of, say, a software company or bank.

- Social. This category covers issues related to employees, supply chain labor, customers, and communities impacted by company operations. Some of these categories are especially important in a given industry. Product safety, for example, is critical to the value of a pharmaceutical company, but less so to that of a publishing company. Good employee relations are universally important for retention and protection of a company's reputation.

- Governance. Good governance rests on sound ethics and transparency. ESG investors look for companies that have a track record of clean accounting, sensible executive compensation (bonuses that are tied to long-term company results, for example), and straightforward, timely communication with shareholders.

Each bit of ESG information is typically rolled up into scores assigned by ESG rating companies. In this way, investors can compare companies across industries or geographies.

Do Green Credit Cards Deliver (opens in new tab)

How Is ESG Performance Related to Intangible Assets?

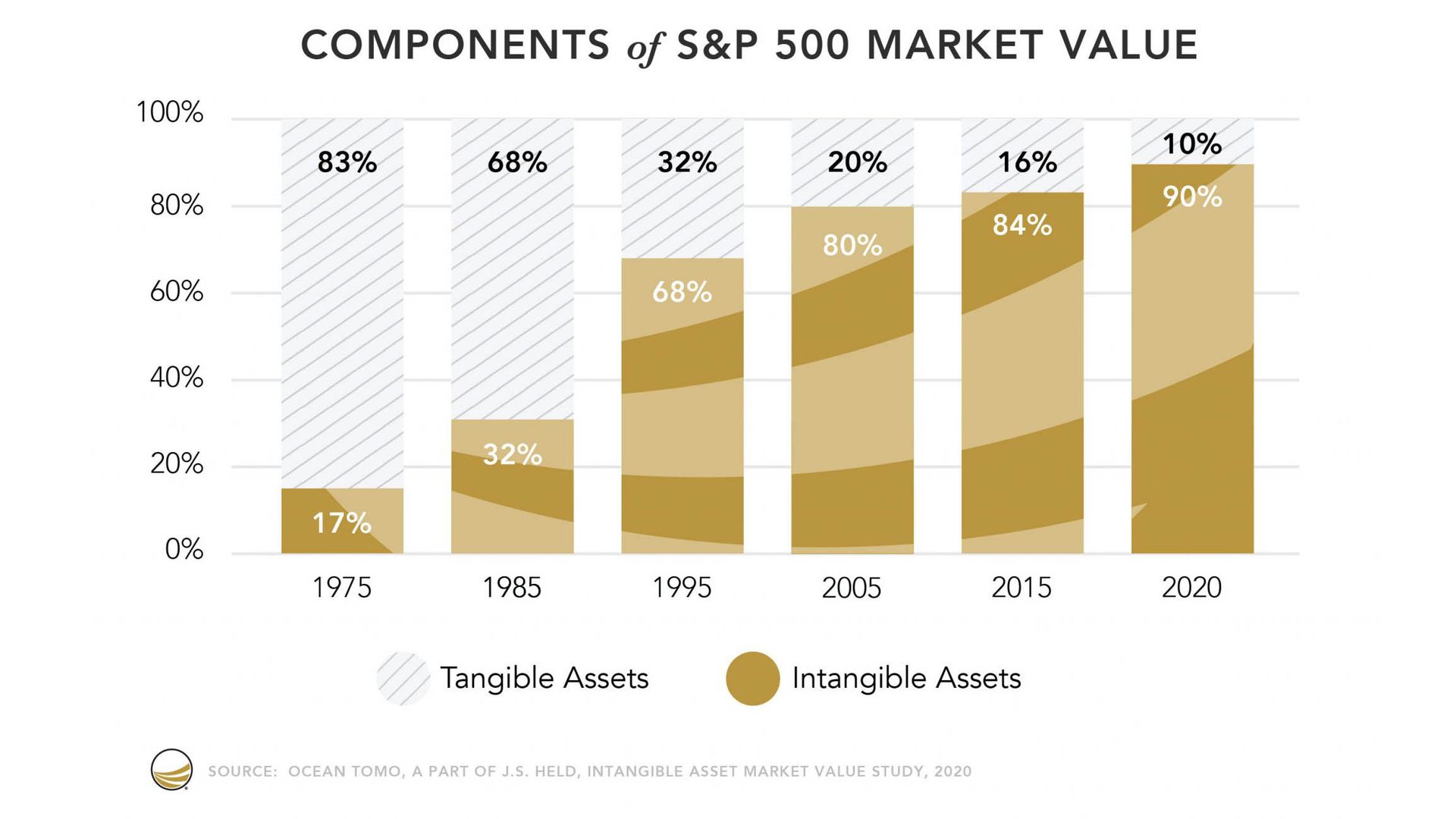

The gold standard of company valuation has relied heavily on the concept of “tangible assets,” which include equipment, land, raw materials, finished products, and other physical goods with a fixed monetary value. In 1975, most companies held in the S&P 500 were considered valuable because of these tangible assets. Only about 17% of company value was derived from “intangible assets” like brand value and human capital—including many of the attributes captured by ESG metrics.

With the boom in information technology and corporate transparency, intangible assets emerged as the greater driver of corporate value. As the chart below demonstrates, intangible assets made up 90% of corporate value on the S&P 500 index by 2020. This change represents an extraordinary shift in the economy.

To understand how the rise of intangible value and ESG are intertwined, consider how much more important employee relations are now compared to the past. “Negotiating power has swung from employer to employee, and turnover rates and wages have skyrocketed as a result,” says Peter Essele (opens in new tab) of Commonwealth Financial Network. “Firms are now implementing unique strategies to attract and retain top talent,” explains Essele, “because increased turnover, in any industry, is costly to the bottom line.”

Is ESG Just Greenwashing?

Is ESG investing merely a marketing scam, engaging in “greenwashing,” or promising better environmental or social outcomes than it delivers? Unfortunately, consumers cannot always know the answer to this question as there is no standard definition of ESG. Remember that ESG was not originally designed to change the world, but to find corporate value that the market had overlooked. If good things came from that investing strategy, then that was seen as a bonus, but not the primary goal.

European governments are cracking down on firms that offer ESG funds (opens in new tab), ensuring that their purpose is made clear to investors. Similar efforts are afoot in the U.S. (opens in new tab) In the meantime, investors for whom impact is the top priority should look for products offered by companies in the U.S. Sustainable Investment Forum (opens in new tab) (USSIF). These firms are more likely to engage directly with companies to address ESG problems and collaborate with non-profit groups on corporate advocacy.

Ellen writes on environmental, social and governance (ESG) investing and sustainability. She was an ESG manager and analyst at Calvert Investments for 15 years, focusing on climate change and consumer staples. She served on the sustainability councils of several Fortune 500 companies, led corporate engagements, and filed shareholder proposals.

Prior to joining Calvert, Ellen was a program officer for Winrock International, managing loans to alternative energy projects in Latin America. She earned a master’s from University of California in international relations and Latin America. She is fluent in Spanish and Portuguese.

-

-

To Afford Retirement, Take Inspiration from ‘The Golden Girls’

To Afford Retirement, Take Inspiration from ‘The Golden Girls’Roommates, a part-time job and renting out your vacation home could be ways to save early in retirement to cover more expensive years later on.

By Erin Wood, CFP®, CRPC®, FBSⓇ • Published

-

Why You Should Teach Your Kids Investing

Why You Should Teach Your Kids InvestingPutting money in the stock market is one of the best ways to build wealth in America. That's why it is so important for parents to teach their kids investing.

By Kyle Woodley • Published