What is a Good Credit Score?

Having a good credit score can save you hundreds, even thousands of dollars on credit cards, mortgages and other loans.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

A credit score is a number, usually between 300 and 850, that provides a snapshot of a consumer’s creditworthiness. Lenders use these scores to decide whether a potential borrower is qualified for a loan, and in many cases, to set the interest rate and other terms. By tracking and keeping a score in the good range or better, consumers may qualify for the best rewards credit cards and other loans.

What is a Good Credit Score?

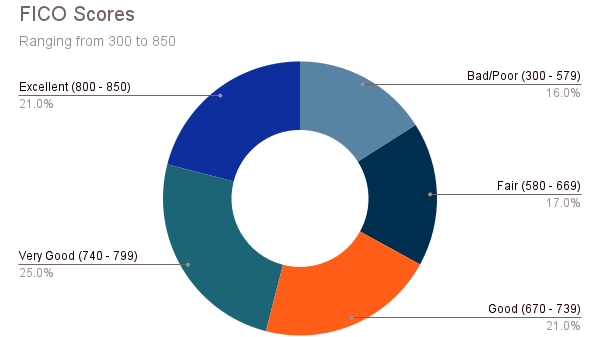

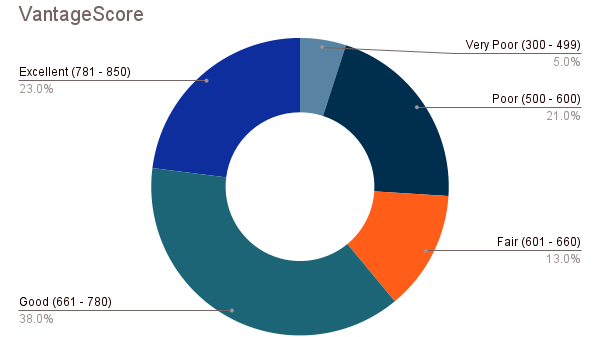

Two companies control the market for credit scores: FICO (opens in new tab) and VantageScore (opens in new tab). FICO considers a score of 670 to 739 as good, while VantageScore rates a score of 661 to 780 as good. FICO boasts that 90% of top lenders rely on their scores, and consumers generally need to focus on their FICO score first. Credit card companies, however, will often look at both FICO and VantageScores.

How Do You Measure Up to Other Borrowers?

The average FICO score in the US was 716 in 2022. And as the chart below demonstrates, about 67% of US consumers had a good credit score, or better, according to Experian (opens in new tab). About 20% of US adults are “credit invisible (opens in new tab)” or “unscorable,” meaning they have no or little credit history, and as a result, no credit score.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The latest versions of the VantageScore also use a 300 to 850 scale, with about 61% of Americans having a Good VantageScore or better.

How to Check Your Credit Score?

There are three ways to see your FICO credit score for free.

- Many banks and credit card issuers offer customers free FICO scores every month, so look at your account online.

- Equifax, one of the three credit bureaus, now offers free scores at myFICO.com/free (opens in new tab).

- Experian also supplies a free score and credit report at www.freecreditscore.com (opens in new tab).

To check your VantageScore, sign up for Chase Bank’s free credit monitory service, Credit Journey (opens in new tab), or see other programs offered by VantageScore (opens in new tab) partners.

Checking your credit score using FICO or Vantage, called a “soft pull,” will not harm your credit score. But when you apply for a credit card or loan, the lender will conduct a “hard pull,” running a report that will temporarily lower your credit score. That is why knowing your credit score is so important before applying for a loan or card. If you have applied for a few credit cards and been rejected, for example, your credit score will be lower and it will be even harder to qualify for a new card until some time has passed and your credit score has recovered.

Why Do I Have More Than One Credit Score?

There are myriad factors that determine your credit score. FICO and VantageScore base their algorithms on the same underlying data but assign a different weight to the same criteria. FICO and VantageScore get these data in turn from three credit bureaus that track your credit activity: Equifax, Experian and TransUnion. As a result, you may see slightly different scores based on whether data was pulled from all three bureaus or just one.

Credit bureau and scoring algorithms also have different versions; sometimes a lender will use a score drawn from the latest version or rely on an older, even years-old version of the algorithm. For example, after a 2022 study by the Consumer Financial Protection Bureau (CFPB) found that the credit scores of one in five Americans are lowered by medical debt (opens in new tab), the three bureaus announced that they would change their credit reports to exclude some forms of medical debt.

What Affects My Credit Score?

Across all of the credit reporting and scoring services, these are the most important factors that go into your credit score.

Payment history is based on your record of paying bills on time and is the most important criterion for determining your score. Late or missed payments can significantly lower your credit score.

Credit utilization reflects the amount of credit you are using relative to your credit limit. Using more than about 30% of your available credit will likely lower your score.

Length of credit history refers to the amount of time you have had your accounts. A long credit history demonstrates that you have had plenty of practice managing debt payments.

Credit mix refers to the types of credit you rely on. Having both installment (mortgages and car loans) and revolving (credit cards) loans will increase your score since it shows you can handle different types of payments and terms.

New credit accounts or applications can lower your credit score by generating a “hard pull” and by lowering your average length of credit history.

Tips for Increasing and Protecting Your Credit Score

Pay your bills on time and if you can, pay the total amount due each month.

Keep your credit utilization low, ideally below 30% of your credit limit

Don’t close old credit card accounts. If you are thinking of closing a credit card that you’ve had for many years in order to avoid an annual fee, consider asking the card issuer to roll the account onto a similar card with no fee. You'll maintain your long credit history even if you never use the card.

Check your credit report and credit score periodically. Look for incorrect information or fraudulent activity, and know how to fix your credit report if you find errors.

Once you get a good, or even excellent credit score, don’t rest on your laurels. Good credit hygiene, like keeping up with all of your credit card or loan payments, can help you qualify for choice loans in the future.

Credit Score Myths

No, not everyone 18 or older in the U.S. has a credit score, even though 42% of Americans think it is true. That's one of the many misconceptions consumers have about how to monitor and build good credit. According to a 2022 study by Capital One Insights Center (opens in new tab), there are a host of myths surrounding credit scores; here are some of the biggest doozies.

My spouse's credit will affect my credit score - False. If your spouse has a low credit score and you apply for a joint loan, that low score may impact your ability to get a loan with good terms, but the score itself will not drag down your own score. To learn more, see How Does Marriage Affect Your Credit Score?

A hard credit check (or credit "pull") will not affect my score - False. There are two kinds of credit card inquiries: hard and soft. Hard inquiries will lower your score temporarily, and too many hard pulls in quick succession could really damage your score. Lenders perform a hard pull when you apply for new credit, like a credit card, a car loan or a mortgage. Hard inquiries stay on your credit report for two years, so it is important think strategically when you want to trigger one. Soft credit checks that will not affect your score include instances when your bank updates your free FICO score, or your employer checks your credit after you are offered a job.

Carrying a balance (not paying the total amount due) on your credit card each month is a good way to increase your credit score - False. Most older consumers knew this statement was false on the Capital One survey, but almost half of millennials polled, and 53% of Gen-Z respondents, thought this statement was true. By not paying your balance in full each month, you risk paying high interest rates and increasing your credit utilization rate, which can lower your credit score.

Related Content

- Best Rewards Credit Cards

- What Does Your Credit Score Really Mean?

- How Does Marriage Affect Your Credit Score?

- 6 Ways to Boost Your Credit Score

- How to Monitor Your Credit Reports for Free

Ellen writes on environmental, social and governance (ESG) investing and sustainability. She was an ESG manager and analyst at Calvert Investments for 15 years, focusing on climate change and consumer staples. She served on the sustainability councils of several Fortune 500 companies, led corporate engagements, and filed shareholder proposals.

Prior to joining Calvert, Ellen was a program officer for Winrock International, managing loans to alternative energy projects in Latin America. She earned a master’s from University of California in international relations and Latin America. She is fluent in Spanish and Portuguese.

-

-

To Afford Retirement, Take Inspiration from ‘The Golden Girls’

To Afford Retirement, Take Inspiration from ‘The Golden Girls’Roommates, a part-time job and renting out your vacation home could be ways to save early in retirement to cover more expensive years later on.

By Erin Wood, CFP®, CRPC®, FBSⓇ • Published

-

Why You Should Teach Your Kids Investing

Why You Should Teach Your Kids InvestingPutting money in the stock market is one of the best ways to build wealth in America. That's why it is so important for parents to teach their kids investing.

By Kyle Woodley • Published

-

How Many Credit Cards Should I Have?

How Many Credit Cards Should I Have?How many credit cards should you have? The answer isn’t as straightforward as you might think — it all depends on your financial situation.

By Erin Bendig • Published

-

Credit Cards vs. Charge Cards: What Are The Differences?

Credit Cards vs. Charge Cards: What Are The Differences?If you pit charge cards vs. credit cards you’ll find that although they are similar, they have a few key differences, most notably that you won't be able to carry a balance with a charge card.

By Erin Bendig • Published

-

Credit card delinquency expected to increase in 2023

Credit card delinquency expected to increase in 2023Credit card and personal loan delinquency rates are expected to increase this year.

By Erin Bendig • Published

-

Best Credit Cards for Bad Credit of May 2023

Best Credit Cards for Bad Credit of May 2023If used wisely, these credit cards can help you dig out of bad credit; you may even earn 2% cash back.

By Lisa Gerstner • Last updated

-

Freeze Your Credit in 3 Steps

Freeze Your Credit in 3 Stepscredit & debt Freezing your accounts at the three major credit bureaus is the best way to prevent thieves from opening new credit accounts in your name.

By Lisa Gerstner • Published

-

How to Monitor Your Credit Reports for Free

How to Monitor Your Credit Reports for Freecredit reports Don't get suckered into paying for credit monitoring services. There are free options all around.

By Rivan V. Stinson • Published

-

Did Equifax Botch Your Credit Score?

Did Equifax Botch Your Credit Score?credit score Equifax is in the news–yet again–this time for sending lenders the wrong credit score. Here’s how to find out if you were affected and what to do next.

By Rivan V. Stinson • Published

-

Two Updates to Credit Reports

Two Updates to Credit Reportscredit & debt The major credit bureaus are changing how they report information about medical debt and buy now, pay later.

By Rivan V. Stinson • Published