The S&P 500 Dividend Aristocrats Have 3 New Members

The illustrious index of stocks that have upped their dividends for at least 25 straight years is up to 67 stocks.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

Long-term dividend-growth investors got some good news recently: The list of Best Dividend Stocks You Can Count On in 2023 and beyond expanded to 67 equities in February.

Standard & Poor's annual rebalancing of the S&P 500 Dividend Aristocrats – an index of S&P 500 companies that have increased their dividends without fail for at least 25 consecutive years – resulted in three additions to the equity income benchmark prior to the market open on Feb. 1.

Although the stocks in the Dividend Aristocrats might not always sport the mightiest of yields, their incomparable track records of dividend growth can help produce superior total returns (price appreciation plus dividends) over the long run.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

That's because regular dividend increases lift the yield on an investor's original cost basis. Stick around long enough, and the modest yield you received on your initial investment can hit double digits one day.

It's called the magic of compounding. As Ben Franklin famously said, "Money makes money. And the money that money makes, makes money."

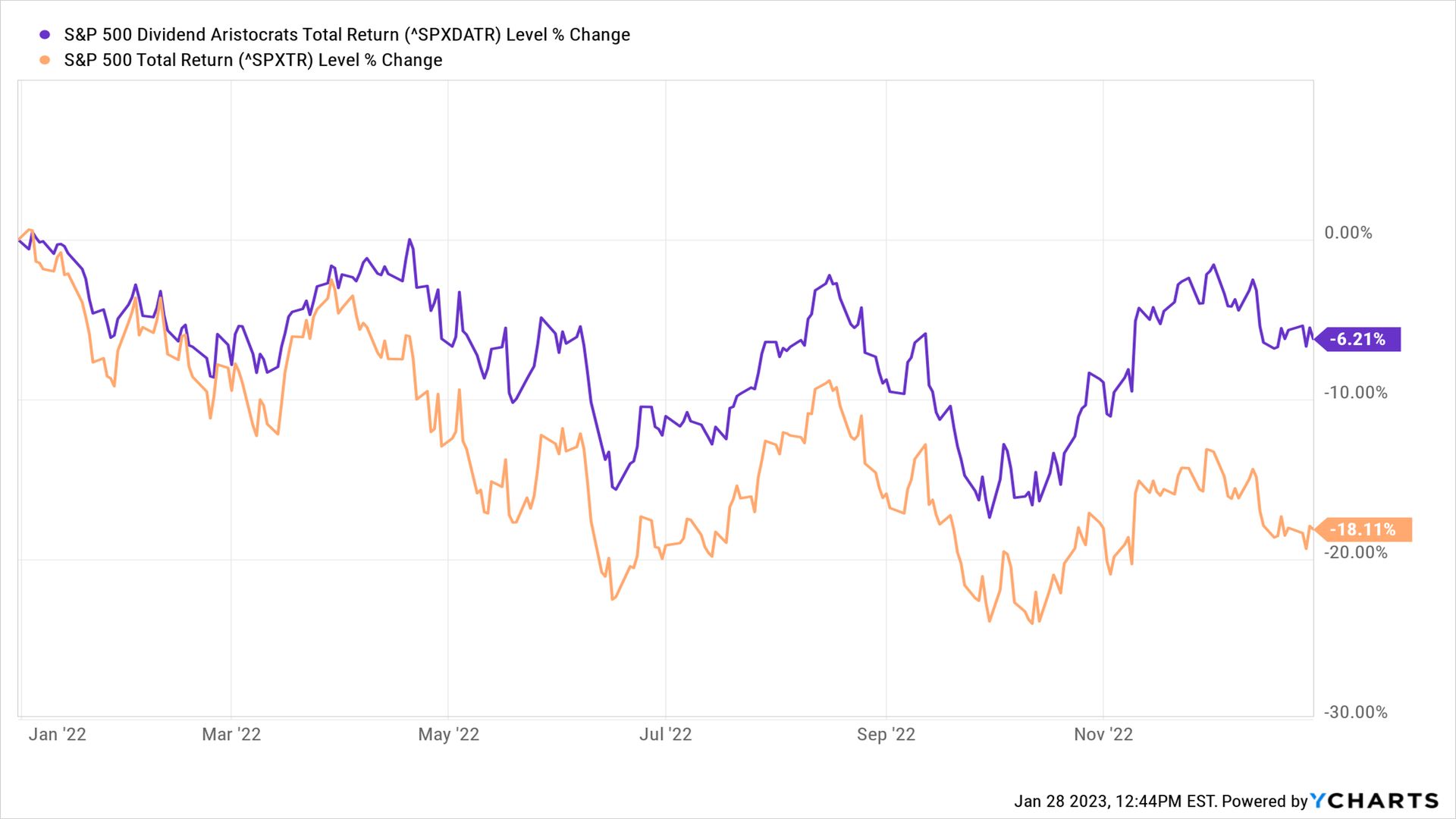

It's also the case that reliable dividend-growth stocks are a decent way to play defense in turbulent market times. Indeed, have a look at the chart below, and you'll see that the S&P 500 Dividend Aristocrats generated a total return of -6.2% in 2022. That beat the broader market's total return by 12 percentage points.

And so, without further ado, here are the 2023 additions to the S&P 500 Dividend Aristocrats (opens in new tab):

J.M. Smucker

- Market value: $16.0 billion

- Dividend yield: 2.7%

- Analysts' consensus recommendation: Hold

J.M. Smucker (SJM (opens in new tab)) is a well-known consumer staples stock thanks to the company's wide range of popular brands. Folgers and Dunkin' coffee, Jif peanut butter and Smucker's eponymous jams and jellies represent just a few of its offerings.

Perhaps less well known is that SJM is an equity income machine, having increased its dividend annually for 25 years, per S&P.

And those dividends sure have come in handy.

Over the past three years, SJM has generated an annualized total return (price appreciation plus dividends) of 15%, vs. 8.6% for the S&P 500. Its more recent performance is even more handsome: Over the past 52 weeks, SJM has generated a total return of 8.4%. The broader market, by comparison, is sitting on a 52-week total return of -7.4%.

Be aware, however, that SJM's recent outperformance has Wall Street mostly sitting on the sidelines at current levels. Of the 16 analysts covering the stock tracked by S&P Global Market Intelligence, one rates it at Strong Buy, 10 have it a Hold, three call it a Sell and two say it's a Strong Sell. That works out to a consensus recommendation of Hold.

Nordson

- Market value: $13.9 billion

- Dividend yield: 1.1%

- Analysts' consensus recommendation: Buy

The inclusion of Nordson (NDSN (opens in new tab)) boosts the industrial sector's representation in the Dividend Aristocrats. The company designs and manufactures systems that dispense, apply and control fluids like adhesives, coatings and sealants. As such, Nordson's customers are found in industries ranging from food packaging and biotechnology to aerospace and semiconductor manufacturing.

Although the yield on the payout might not wow investors, Nordson's epic streak of dividend increases certainly proves the company's commitment to returning cash to shareholders. S&P says the company has hiked its payout for 42 consecutive years. By Nordson's count, it's raised the dividend for 59 straight years. (opens in new tab)

(Either way, Nordson became eligible for inclusion to the Dividend Aristocrats when it was added to the S&P 500 in February 2022.)

And make no mistake, those regular bumps to the dividend have helped NDSN become a long-time market beater. Indeed, shares have outperformed the broader market on an annualized total return basis over the past one, three, five, 10, 15 and 20 years.

Of the 11 analysts covering the stock tracked by S&P Global Market Intelligence, five rate it at Strong Buy and six call it a Hold. That works out to a consensus recommendation of Buy, albeit with mixed conviction.

C.H. Robinson Worldwide

- Market value: $11.7 billion

- Dividend yield: 2.5%

- Analysts' consensus recommendation: Hold

C.H. Robinson Worldwide (CHRW (opens in new tab)) provides freight transportation and logistics services to industries around the globe. It also delivers reliable increases to its dividend each and every year.

The company joins the Dividend Aristocrats in February by dint of its 25-year streak of payout hikes. The most recent increase was announced in November 2022 – a 10.9% bump in the disbursement to 61 cents per share quarterly.

CHRW stock has a mixed record when compared to the broader market over the longer term. Shares have outperformed the S&P 500 on an annualized total return basis over the past one- and three-year periods, but are laggards over the past five, 10 and 15 years. Going back 20 years, CHRW's annualized total return beats the S&P 500 by a bit more than 2 percentage points.

The Street isn't particularly bullish on the stock's prospects at current levels, at least not over the next 12 to 18 months. Of the 28 analysts covering CHRW, three rate it at Strong Buy, one says Buy, 17 have it at Hold, three call it a Sell and four say it's a Strong Sell. That works out to a consensus recommendation of Hold, with a negative tilt.

Dan Burrows is Kiplinger's senior investing writer, having joined the august publication full time in 2016.

A long-time financial journalist, Dan is a veteran of SmartMoney, MarketWatch, CBS MoneyWatch, InvestorPlace and DailyFinance. He has written for The Wall Street Journal, Bloomberg, Consumer Reports, Senior Executive and Boston magazine, and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among other publications. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange and hosted a weekly video segment on equities.

In his current role at Kiplinger, Dan writes about equities, fixed income, currencies, commodities, funds, macroeconomics, demographics, real estate, cost of living indexes and more.

-

-

What Peloton Riders — and Investors — Should Know About a Bike Recall

What Peloton Riders — and Investors — Should Know About a Bike RecallPeloton has recalled popular exercise bikes, affecting millions of riders and shareholders.

By Ben Demers • Published

-

Is Etsy Stock Finally a Buy?

Is Etsy Stock Finally a Buy?Etsy stock might be the bargain investors have been waiting for now that it's 70% off its all-time high.

By Dan Burrows • Published

-

Stock Market Today: Disney Earnings Drag on Dow

Stock Market Today: Disney Earnings Drag on DowAn unexpected decline in subscribers weighed on Disney stock Thursday, while notable deposit outflows sent PacWest tumbling.

By Karee Venema • Published

-

Stock Market Today: Stocks Lose Steam After CPI Report

Stock Market Today: Stocks Lose Steam After CPI ReportStocks wavered after the April CPI report supported the case for the Fed to stop raising rates – but not cut them.

By Dan Burrows • Published

-

Stock Market Today: Stocks Churn Ahead of April CPI Report

Stock Market Today: Stocks Churn Ahead of April CPI ReportThe major market indexes made modest moves Tuesday as investors awaited debt-ceiling updates and inflation data.

By Karee Venema • Published

-

Stock Market Today: Stocks Choppy With Inflation Data on Deck

Stock Market Today: Stocks Choppy With Inflation Data on DeckThe major indexes struggled for direction Monday amid more volatility in regional bank stocks and ahead of this week's key inflation updates.

By Karee Venema • Published

-

Warren Buffett's Berkshire Hathaway Stock Is Taking Off

Warren Buffett's Berkshire Hathaway Stock Is Taking OffBerkshire Hathaway stock has been clobbering the broader market since the banking crisis set in.

By Dan Burrows • Published

-

Stock Market Today: Apple Earnings, Bank Stocks Spark Relief Rally

Stock Market Today: Apple Earnings, Bank Stocks Spark Relief RallyThe April jobs report creates uncertainty around the Fed's future policy plans, but it didn't stop the major indexes from soaring Friday.

By Karee Venema • Published

-

Stock Market Today: Stocks Slide as Regional Bank Rout Worsens

Stock Market Today: Stocks Slide as Regional Bank Rout WorsensThe major market indexes closed lower Thursday as chaos in the banking industry continued.

By Karee Venema • Published

-

Stock Market Today: Stocks Pop, Then Drop After Fed Rate Hike

Stock Market Today: Stocks Pop, Then Drop After Fed Rate HikeThe major indexes couldn't make heads or tails of the latest Fed statement, ultimately ending the session in the red.

By Karee Venema • Published