Social Security Optimization If You Save More Than $250,000

When you choose to take benefits will make a difference in how your income and assets play out over many years. Let’s explore some scenarios.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

If you have less than $250,000 saved for retirement, chances are your Social Security retirement benefits could be the main source of your retirement income. If this is true, then you may want to consider working as long as you can, or until age 70, and delay your retirement benefit so it can grow as much as possible. However, if you have more than $250,000 saved up for retirement, deciding when you should file for Social Security becomes a more nuanced question. Why? It’s because there can be a rippling effect throughout the rest of your retirement plan.

Assuming that your target retirement age is around 60 years old, and you expect a certain amount of income each year with a cost-of-living adjustment, your plan would need to account for the gap between when you retire and when your Social Security benefit starts.

Filing for Social Security Too Early vs. Too Late

For example, if you had a target retirement date of 60 years old and file for your Social Security benefits at 62 years and one month, you’d have a gap of about two years between when you retire and when you start receiving your benefit. That means you’d potentially have to take additional income to bridge the gap or make up the difference until your Social Security benefit started.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

If you had a target retirement date of 60 years old and intended to file for your Social Security benefits at age 70, you’d have a 10-year gap, which could have an even greater impact on your portfolio as you bridge the gap.

Admittedly, there’s no simple solution. Filing early, like around 62 or 63, has its benefits and detriments. The same goes for those who decide to file late, as in around 68 to 70. Here’s an expression I came up with some years ago to help explain how to compare the benefits and detriments potentially found when you consider your Social Security filing strategies: If you file too early, your income may be hurting. If you file too late, you could be hurting your estate.

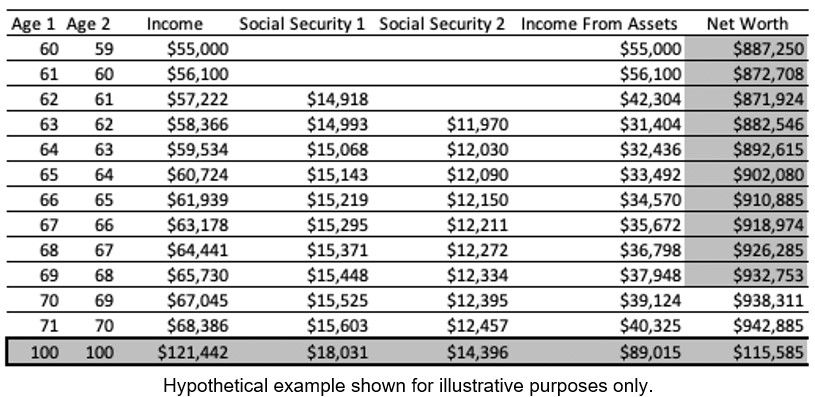

Let’s address each option. Here is a quick breakdown of what it could look like if you were to file early.

Strategy 1: Take Social Security Early

The third column above shows the total projected retirement income for a couple with one spouse who’s younger than the other. They start receiving the older spouse’s Social Security benefit at age 62 (column four). Column five represents the younger spouse’s benefit. The projected net worth, column seven, has an assumed growth rate of 5%.

Notice how the net worth at age 71 is projected to be $942,885, and at age 100, the net worth is projected to be $115,585. During the first 10 years, because Social Security had been turned on early, the estate was better preserved. In other words, this couple did not have to take as much income from their assets to meet their retirement income goal.

Now let’s look at the other strategy and then compare.

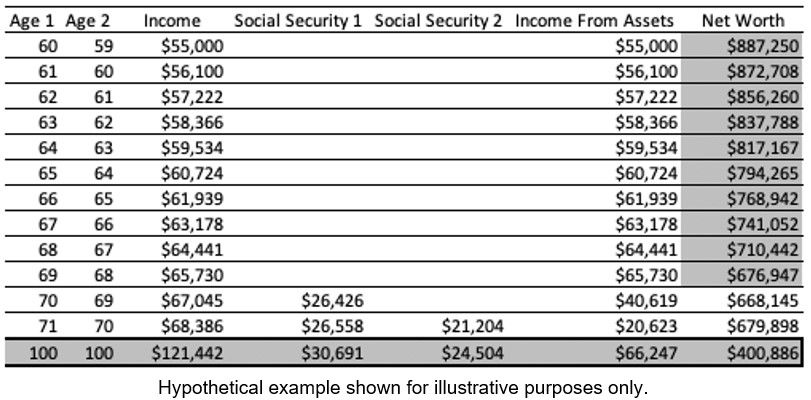

Strategy 2: Take Social Security Late

In this strategy, notice how the net worth goes further down during the first 10 years than in the first example. This is because more income must be pulled from assets to meet the target retirement income. Essentially, the assets are bridging the gap between when this couple retires and when they file for Social Security. Once Social Security turns on at age 70, the portfolio doesn’t have to provide as much income to meet the retirement income goal.

When someone files for their Social Security benefit at 70 years old, they claim their maximum possible benefit. This helps the portfolio, growing at an assumed 5% annually, recover. This is why the portfolio has the potential to recover and is projected to be around $400,886 by age 100.

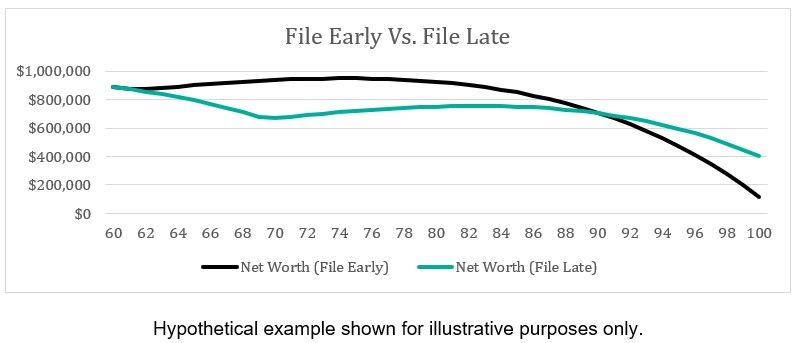

Let’s compare what the projected net worth looks like in both scenarios.

Notice how the net worth goes down when you file late. That is because the portfolio is providing all the retirement income. The green Net Worth (File Early) line illustrates how taking Social Security early, even at a discount, requires less income from the portfolio, helping the portfolio maintain a higher total balance.

It’s important to note the differences based on the years. When you compare the projected net worth at age 69, Strategy 1 projects a net worth of $932,753, while Strategy 2 projects $676,947, a $255,806 difference. That’s a lot of money potentially going to beneficiaries.

Now let’s compare the two strategies at age 100. Strategy 1 projects a net worth of $115,585, while Strategy 2 projects $400,886, a $285,301 difference. Again, that’s a lot of money to beneficiaries.

In conclusion, when you consider your Social Security strategy, it is important to review how when you file could affect your portfolio. If you are more concerned about passing as much as you can to your beneficiaries, then you may consider filing early to preserve more of your portfolio in the earlier part of your retirement. If you want to maximize your income, you may consider filing late to get the highest benefit possible.

A few other factors that may affect when you should file include how much you expect to get at full retirement age, does your spouse qualify for their own benefit, or does it make sense to consider the spousal benefits, your total retirement income and how that income is generated, and so on.

The folks who work at the Social Security Administration (opens in new tab) can help answer some questions, but they are limited in what they can and cannot do. Working with a financial adviser or using third-party software to run the numbers on your potential lifetime benefits can make a huge difference.

Social Security optimization is a nuanced process. There’s no silver bullet here. The trick is to file for your benefit based on what you value more — protecting your estate or maximizing your income.

This article was written by and presents the views of our contributing adviser, not the Kiplinger editorial staff. You can check adviser records with the SEC (opens in new tab) or with FINRA (opens in new tab).

Mike Decker is the author of the book How to Retire on Time and the founder of Kedrec (opens in new tab), a Registered Investment Advisory firm located in Kansas that specializes in comprehensive wealth planning and management at a flat fee. He helps people create retirement plans that are designed to last longer than them, without relying on annuitized income streams or risky stock/bond portfolios.

-

-

To Afford Retirement, Take Inspiration from ‘The Golden Girls’

To Afford Retirement, Take Inspiration from ‘The Golden Girls’Roommates, a part-time job and renting out your vacation home could be ways to save early in retirement to cover more expensive years later on.

By Erin Wood, CFP®, CRPC®, FBSⓇ • Published

-

Why You Should Teach Your Kids Investing

Why You Should Teach Your Kids InvestingPutting money in the stock market is one of the best ways to build wealth in America. That's why it is so important for parents to teach their kids investing.

By Kyle Woodley • Published

-

To Afford Retirement, Take Inspiration from ‘The Golden Girls’

To Afford Retirement, Take Inspiration from ‘The Golden Girls’Roommates, a part-time job and renting out your vacation home could be ways to save early in retirement to cover more expensive years later on.

By Erin Wood, CFP®, CRPC®, FBSⓇ • Published

-

Career Transition? Three Steps to Protect Your Financial Health

Career Transition? Three Steps to Protect Your Financial HealthWhether you’ve been laid off or are moving on voluntarily, career transitions can be stressful, but there are ways to help tame the uncertainty.

By Krystal Barker Buissereth, CFA® • Published

-

Three Legal Documents Your Child Should Sign When They Turn 18

Three Legal Documents Your Child Should Sign When They Turn 18Legal documents such as durable power of attorney, a healthcare proxy and a HIPAA release can give parents the legal right to make decisions if their child needs help.

By Allen J. Falke, CPA, Esq., LL.M. • Published

-

Preparing for the Next Recession: Six Considerations for Retirees

Preparing for the Next Recession: Six Considerations for RetireesBeing more disciplined and risk averse in the good times can make it easier to weather the bad times when they inevitably arrive.

By Craig Kirsner, Investment Adviser Representative • Published

-

Finances Aside, What Does a Happy Retirement Look Like?

Finances Aside, What Does a Happy Retirement Look Like?Three examples of retirees show what it means to thrive in retirement. The common denominators provide clues on how to swing your own happy retirement.

By Dennis D. Coughlin, CFP, AIF • Published

-

Will You Pay Higher Taxes in Retirement?

Will You Pay Higher Taxes in Retirement?Your Social Security income and RMDs will most likely combine to deliver a tax torpedo, but there are ways to reduce your income in retirement to pay less tax.

By Joe F. Schmitz Jr., CFP®, ChFC® • Published

-

Inherited Retirement Plan? How to Easily Understand Payout Rules

Inherited Retirement Plan? How to Easily Understand Payout RulesFiguring out first which kind of beneficiary you are will make it easier to grasp the rules and timing on required distributions.

By Mike Piershale, ChFC • Published

-

For Financial Planning Success Now, Start by Looking at the Past

For Financial Planning Success Now, Start by Looking at the PastCertain beliefs could be impeding your financial planning, and learning what those are begins with exploring your money-related memories.

By Jamie P. Hopkins, Esq., CFP, RICP • Published