If You'd Put $1,000 Into Nvidia Stock 20 Years Ago, Here's What You'd Have Today

Nvidia stock has been a market-beater recently, but has it always been such a winner?

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

Nvidia (NVDA (opens in new tab)) stock has been a rare winner amid the market's recent swoon, but then long-time shareholders should be used to that sort of thing by now.

That's because despite its high volatility – and some rather vertiginous ups and downs along the way – this semiconductor stock has vastly outperformed the broader market since going public at the end of the last century.

But before we take a look at Nvidia stock's illustrious past, let's recap how it's been doing recently.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

After losing half its value last year – and attracting some bargain-hunting billionaire investors around its share-price nadir – NVDA stock was up 62% through the first eight weeks of 2023. That led the S&P 500 by a whopping 57 percentage points.

A chunk of those returns came on Feb. 23 alone, when shares rallied 14% following Nvidia's quarterly earnings report (opens in new tab). The market was especially happy to see robust growth in the firm's data center business. For that week as a whole, NVDA stock gained 8.9%. Meanwhile, the S&P 500 suffered its worst weekly performance since early December of last year.

Nvidia stock's market-beating ways go much farther back than that, however. In fact, few stocks have done more for investors over the past few decades than Nvidia. From its initial public offering at $12 a share in January 1999 through December 2020, NVDA stock created $309.4 billion in shareholder wealth, according to an analysis by Hendrik Bessembinder, a finance professor at the W.P. Carey School of Business (opens in new tab) at Arizona State University.

Indeed, per Bessembinder's findings, which account for a stock's increase in market value adjusted for cash flows in and out of the business and other adjustments, Nvidia is one of the 30 best stocks of the past 30 years.

Looked at another way, over just 24 years as a publicly traded company, Nvidia stock generated an annualized total return of 26.9%. The S&P 500, with dividends reinvested, returned an annualized 9.8% over the same period.

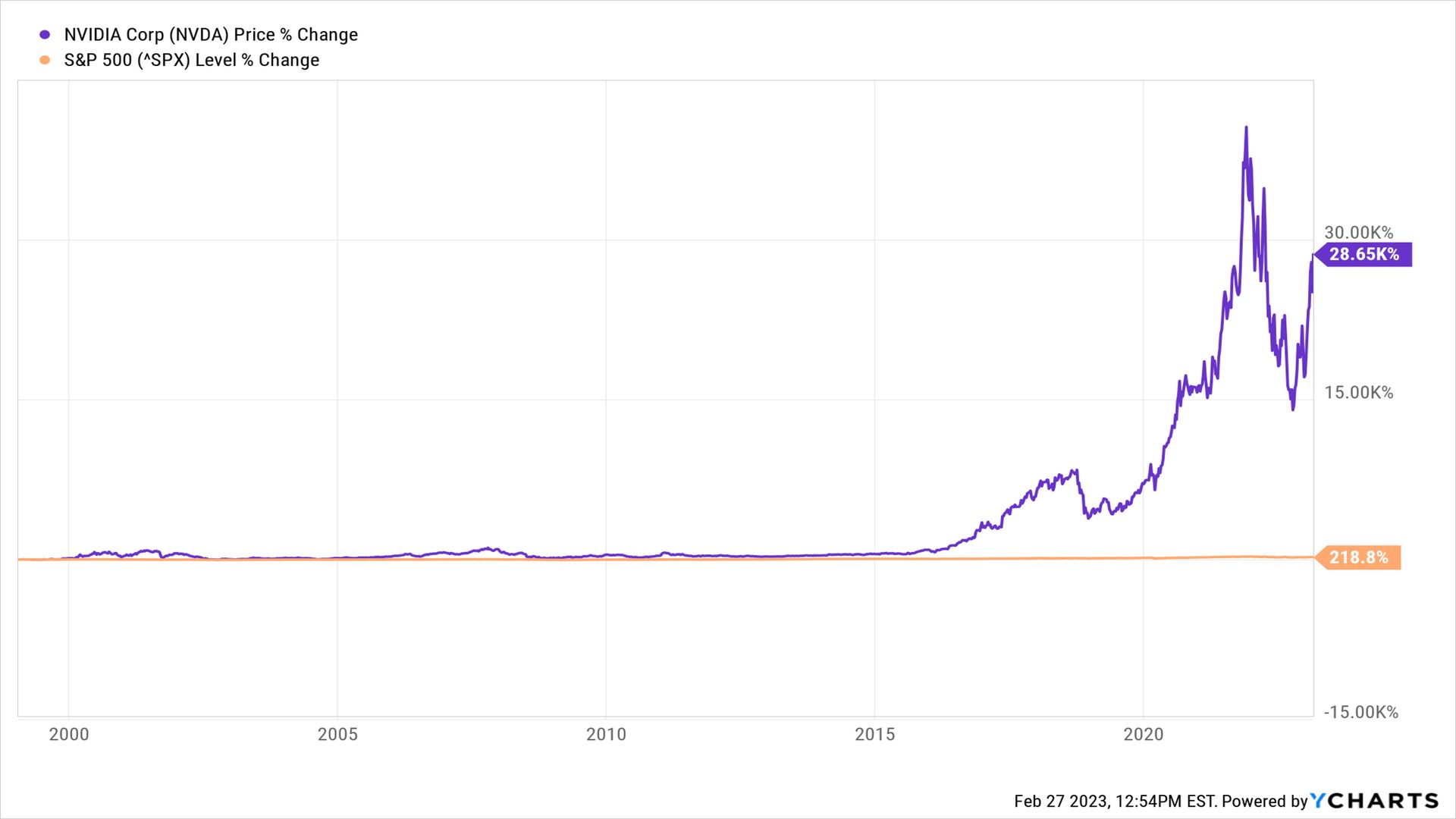

Have a look at the chart below comparing Nvidia stock's all-time performance vs. the performance of the broader market.

As you can see in the chart, most of the shareholder wealth generated by Nvidia came over just the past four years. That's because back in the day, the primary market for Nvidia's graphics processing units (GPUs) consisted of PC and console video game enthusiasts.

Happily for Nvidia, it just so happens that the company's powerful GPUs and related intellectual property are indispensable to the fields of artificial intelligence (AI), professional visualization, cryptocurrency mining and more. As noted above, NVDA processors are increasingly in demand for use in data centers.

Few blue chip stocks offer so much exposure to so many emerging endeavors, which helps explain NVDA stock's meteoric rise.

But as remarkable as the above chart may be, it doesn't quite get to the heart of what NVDA stock has meant to long-term shareholders and their brokerage statements. For that, consider the following facts about Nvidia stock:

The Bottom Line on Nvidia Stock?

Over the past two decades, Nvidia stock generated a total return of more than 24,000%, or 31.6% annualized.

Therefore, if you invested $1,000 in Nvidia stock 20 years ago, today it would be worth more than $241,000.

More Stocks of the Past 20 Years

- If You'd Put $1,000 Into Netflix Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Apple Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Amazon Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Microsoft Stock 20 Years Ago, Here's What You'd Have Today

Dan Burrows is Kiplinger's senior investing writer, having joined the august publication full time in 2016.

A long-time financial journalist, Dan is a veteran of SmartMoney, MarketWatch, CBS MoneyWatch, InvestorPlace and DailyFinance. He has written for The Wall Street Journal, Bloomberg, Consumer Reports, Senior Executive and Boston magazine, and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among other publications. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange and hosted a weekly video segment on equities.

In his current role at Kiplinger, Dan writes about equities, fixed income, currencies, commodities, funds, macroeconomics, demographics, real estate, cost of living indexes and more.

-

-

Courts to Rule on Agency Powers: Kiplinger Economic Forecasts

Courts to Rule on Agency Powers: Kiplinger Economic ForecastsEconomic Forecasts The scope of agency power is under the spotlight in cases in the Supreme and Federal Courts: Kiplinger Economic Forecasts

By Letter Editors • Published

-

Deeper Regional Banking Crisis Unlikely after Triple Failure: Kiplinger Economic Forecasts

Deeper Regional Banking Crisis Unlikely after Triple Failure: Kiplinger Economic ForecastsEconomic Forecasts Deeper Regional Banking Crisis Unlikely after Triple Failure: Kiplinger Economic Forecasts

By Rodrigo Sermeño • Published

-

Stock Market Today: Stocks Slip as Consumer Sentiment Slides

Stock Market Today: Stocks Slip as Consumer Sentiment SlidesConcerns about the debt ceiling also weighed on stocks Friday.

By Karee Venema • Published

-

Stock Market Today: Disney Earnings Drag on Dow

Stock Market Today: Disney Earnings Drag on DowAn unexpected decline in subscribers weighed on Disney stock Thursday, while notable deposit outflows sent PacWest tumbling.

By Karee Venema • Published

-

Stock Market Today: Stocks Lose Steam After CPI Report

Stock Market Today: Stocks Lose Steam After CPI ReportStocks wavered after the April CPI report supported the case for the Fed to stop raising rates – but not cut them.

By Dan Burrows • Published

-

Stock Market Today: Stocks Churn Ahead of April CPI Report

Stock Market Today: Stocks Churn Ahead of April CPI ReportThe major market indexes made modest moves Tuesday as investors awaited debt-ceiling updates and inflation data.

By Karee Venema • Published

-

Stock Market Today: Stocks Choppy With Inflation Data on Deck

Stock Market Today: Stocks Choppy With Inflation Data on DeckThe major indexes struggled for direction Monday amid more volatility in regional bank stocks and ahead of this week's key inflation updates.

By Karee Venema • Published

-

Warren Buffett's Berkshire Hathaway Stock Is Taking Off

Warren Buffett's Berkshire Hathaway Stock Is Taking OffBerkshire Hathaway stock has been clobbering the broader market since the banking crisis set in.

By Dan Burrows • Published

-

Stock Market Today: Apple Earnings, Bank Stocks Spark Relief Rally

Stock Market Today: Apple Earnings, Bank Stocks Spark Relief RallyThe April jobs report creates uncertainty around the Fed's future policy plans, but it didn't stop the major indexes from soaring Friday.

By Karee Venema • Published

-

Stock Market Today: Stocks Slide as Regional Bank Rout Worsens

Stock Market Today: Stocks Slide as Regional Bank Rout WorsensThe major market indexes closed lower Thursday as chaos in the banking industry continued.

By Karee Venema • Published