If You'd Put $1,000 Into Apple Stock 20 Years Ago, Here's What You'd Have Today

Apple stock has lost more than $500 billion in value since its peak, but its long-term performance tells another story.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

Apple (AAPL (opens in new tab)) stock has rebounded sharply this year after a terrible 2022, but shares still remain well below their all-time high.

Even after gaining nearly 19% for the year-to-date – vs. a 5.8% rise in the S&P 500 – Apple stock is still some 17% below its record close of early 2022. In the process, Apple's market capitalization has dropped to $2.45 trillion from $2.97 trillion – a loss of more than a half-trillion dollars in shareholder value.

That's painful for anyone who came to the Apple party late, but it's tough to have much pity for truly long-time shareholders. After all, they've enjoyed almost incomparable returns over the past few decades.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

From January 1990 through December 2020, AAPL stock created $2.67 trillion in shareholder wealth, or an annualized dollar weighted return of 23.5%, according to an analysis by Hendrik Bessembinder, a finance professor at the W.P. Carey School of Business (opens in new tab) at Arizona State University.

Indeed, per Bessembinder's findings, which account for a stock's increase in market value adjusted for cash flows in and out of the business and other adjustments, Apple is one of the 30 best stocks of the past 30 years.

True, AAPL stock traded sideways for the first few years of the 21st century, but an explosion of innovation soon put an end to that. Under the visionary leadership of the late Steve Jobs, Apple essentially reinvented itself for the mobile age, launching revolutionary gadgets such as the iPod, MacBook and iPad.

But what really set Apple on its course to becoming the world's largest publicly traded company – and one of hedge funds' favorite blue chip stocks — was the 2007 debut of the iPhone.

Today, Apple isn't just a purveyor of gadgets; it sells an entire ecosystem of personal consumer electronics and related services. And it's a sticky ecosystem at that.

No less an eminence than Warren Buffett has called the iPhone maker Berkshire Hathaway's (BRK.B (opens in new tab)) "third business," noting Apple fans' fantastic brand loyalty as one reason for being all-in on the stock. (Apple accounts for almost 39% of the value of the Berkshire Hathaway equity portfolio.)

No wonder the iconic tech firm was tapped to become one of the elite 30 Dow stocks. In 2015, Apple replaced AT&T (T (opens in new tab)) in the Dow Jones Industrial Average.

The Bottom Line on Apple Stock?

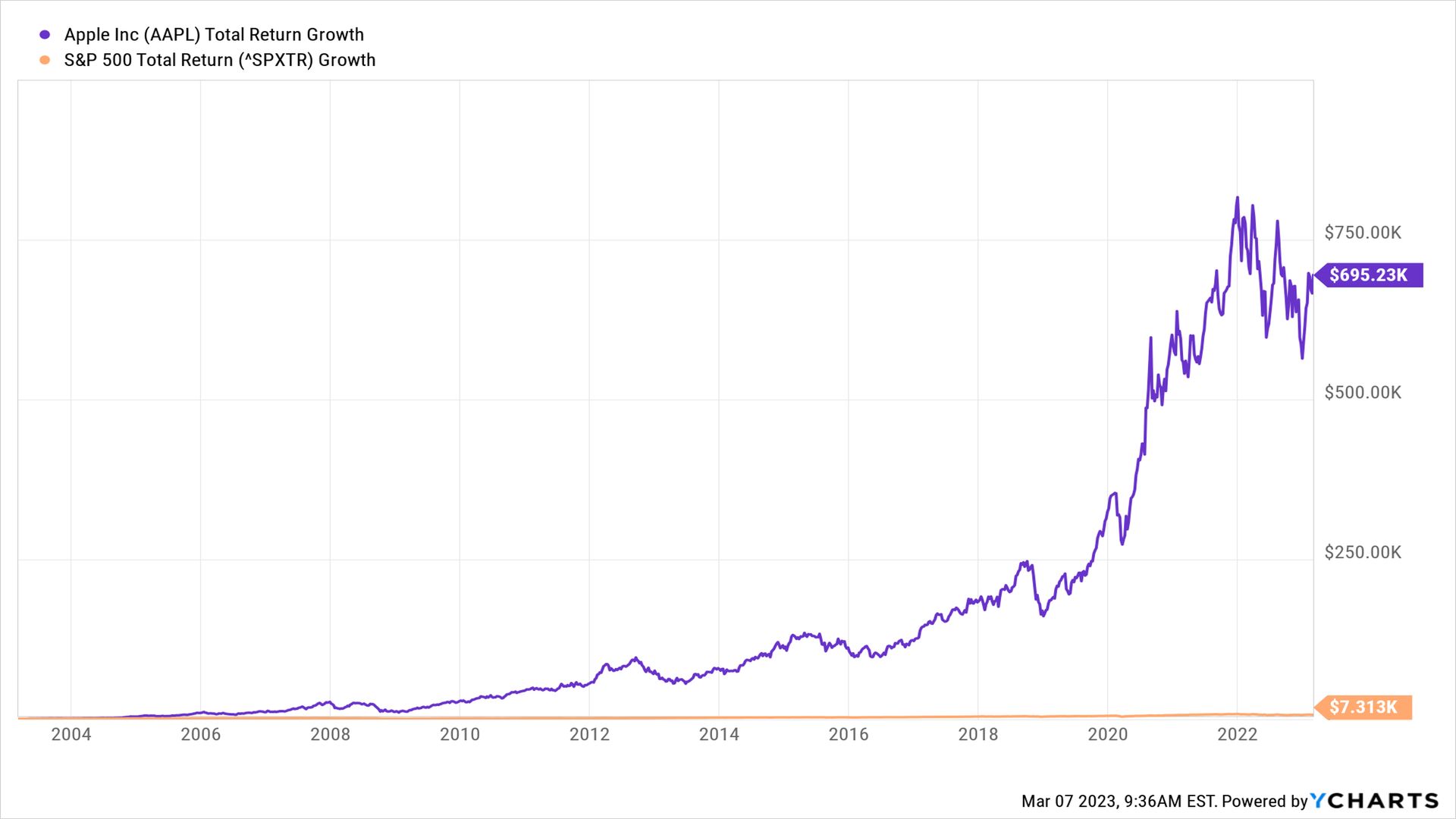

Over the past two decades, Apple stock generated a total return (price change plus dividends) of more than 69,000%, or more than 38% annualized.

Have a look at the above chart and you'll see that if you invested $1,000 in Apple stock 20 years ago, it would be worth more than $695,000 today. By comparison, the same $1,000 invested in the S&P 500 would have theoretically turned into a bit more than $7,300 over the same period.

For those wondering if AAPL stock is a buy at current levels, Wall Street certainly thinks so. Of the 45 analysts covering Apple stock tracked by S&P Global Market Intelligence, 25 rate it at Strong Buy, nine say Buy and nine call it a Hold. One analyst slaps a rare Sell rating on shares, and one has it at Strong Sell. That works out to a consensus recommendation of Buy, with high conviction.

Meanwhile, the Street's average target price of $169 gives AAPL stock implied upside of about 10% over the next 12 months or so.

More Stocks of the Past 20 Years

- If You'd Put $1,000 Into Amazon Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Nvidia Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Netflix Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Microsoft Stock 20 Years Ago, Here's What You'd Have Today

Dan Burrows is Kiplinger's senior investing writer, having joined the august publication full time in 2016.

A long-time financial journalist, Dan is a veteran of SmartMoney, MarketWatch, CBS MoneyWatch, InvestorPlace and DailyFinance. He has written for The Wall Street Journal, Bloomberg, Consumer Reports, Senior Executive and Boston magazine, and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among other publications. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange and hosted a weekly video segment on equities.

In his current role at Kiplinger, Dan writes about equities, fixed income, currencies, commodities, funds, macroeconomics, demographics, real estate, cost of living indexes and more.

-

-

Travel demand and delays to soar, so plan ahead: Kiplinger Economic Forecasts

Travel demand and delays to soar, so plan ahead: Kiplinger Economic ForecastsEconomic Forecasts Travel demand and delays to soar, so plan ahead: Kiplinger Economic Forecasts

By Sean Lengell • Published

-

To Afford Retirement, Take Inspiration from ‘The Golden Girls’

To Afford Retirement, Take Inspiration from ‘The Golden Girls’Roommates, a part-time job and renting out your vacation home could be ways to save early in retirement to cover more expensive years later on.

By Erin Wood, CFP®, CRPC®, FBSⓇ • Published

-

Stock Market Today: Stocks Slip as Consumer Sentiment Slides

Stock Market Today: Stocks Slip as Consumer Sentiment SlidesConcerns about the debt ceiling also weighed on stocks Friday.

By Karee Venema • Published

-

Stock Market Today: Disney Earnings Drag on Dow

Stock Market Today: Disney Earnings Drag on DowAn unexpected decline in subscribers weighed on Disney stock Thursday, while notable deposit outflows sent PacWest tumbling.

By Karee Venema • Published

-

Disney Stock Tumbles: Time to Buy?

Disney Stock Tumbles: Time to Buy?Analysts say Disney stock is a buy on weakness after shares sell off on a subscriber miss.

By Dan Burrows • Last updated

-

Stock Market Today: Stocks Lose Steam After CPI Report

Stock Market Today: Stocks Lose Steam After CPI ReportStocks wavered after the April CPI report supported the case for the Fed to stop raising rates – but not cut them.

By Dan Burrows • Published

-

Stock Market Today: Stocks Churn Ahead of April CPI Report

Stock Market Today: Stocks Churn Ahead of April CPI ReportThe major market indexes made modest moves Tuesday as investors awaited debt-ceiling updates and inflation data.

By Karee Venema • Published

-

Stock Market Today: Stocks Choppy With Inflation Data on Deck

Stock Market Today: Stocks Choppy With Inflation Data on DeckThe major indexes struggled for direction Monday amid more volatility in regional bank stocks and ahead of this week's key inflation updates.

By Karee Venema • Published

-

Warren Buffett's Berkshire Hathaway Stock Is Taking Off

Warren Buffett's Berkshire Hathaway Stock Is Taking OffBerkshire Hathaway stock has been clobbering the broader market since the banking crisis set in.

By Dan Burrows • Published

-

Stock Market Today: Apple Earnings, Bank Stocks Spark Relief Rally

Stock Market Today: Apple Earnings, Bank Stocks Spark Relief RallyThe April jobs report creates uncertainty around the Fed's future policy plans, but it didn't stop the major indexes from soaring Friday.

By Karee Venema • Published