Can My Pension Trigger a Retirement Tax Bomb?

Key planning strategies like asset location and Roth conversions can dramatically reduce the taxes you pay throughout retirement and your heirs’ tax liability.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

The multiple-part series I published on Kiplinger.com on “retirement tax bombs” has been a huge hit with investors. I heard directly from many of you who expressed that you were always worried about these issues but hadn’t ever heard anyone talk about them or give practical advice.

If you haven’t read the series, I’d suggest you start with part 1: Is Your Retirement Portfolio a Tax Bomb? You can find links to all seven articles plus the bonus article at the bottom of this article.

In this article, I’ll explore another common case I see in which a couple is retiring and has saved some in tax-deferred accounts, but also has a defined benefit pension. I’ll contrast this couple with the couple from the first bonus article 2 Ways Retirees Can Defuse a Tax Bomb (It’s Not Too Late!), who had saved more in tax-deferred accounts but didn’t have a pension. And I’ll explore how asset location and annual Roth conversion strategies can help diffuse our pensioner’s retirement tax bomb.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

A pension is a wonderful retirement benefit that provides lifetime income no matter how long you live. Along with Social Security, it establishes a solid income floor that can enable retirees to enjoy a comfortable retirement. Another way to think of a pension is that the present value of the pension income stream is very similar to a large tax-deferred retirement account, with a similar tax liability.

Taxable Income From a Pension vs. RMDs

The main difference is that the taxable income from a pension is likely smoother throughout retirement compared to taxable required minimum distributions (RMDs) from tax-deferred savings, which can grow larger over time from account growth and the way RMDs are calculated.

This case study involves a married couple who just retired at age 63. In almost every respect, this couple is just like the couple from the first bonus article, except they have $2 million less in retirement savings, but have a defined benefit pension with a $120,000 annual benefit, with no cost-of-living adjustment (COLA).

They each plan to file for Social Security at age 67 with a combined benefit of $68,000. Except for the pension, they have no other sources of income.

They have an investment portfolio of $1 million, of which $700,000 is tax deferred, $200,000 is taxable, and $100,000 is Roth. Their investments are not asset located, with the same asset allocation in each tax bucket. I assume expected returns of 4% for bonds and 9% for stocks. They’re invested in a moderate growth portfolio with a 60% stock, 40% bond allocation that has an expected annual return of 7%.

They have $150,000 of recurring annual expenses throughout retirement, so their guaranteed income from the pension and Social Security should completely meet their core spending needs. They live in a state with no state income tax.

Note that the present value of the pension is about $1.4 million, using a 7% discount rate (the expected annual return on their 60% stock strategy). That’s similar to the $1.5 million difference in tax-deferred savings between the pension couple and the couple in the first bonus article.

Let’s first examine what their current retirement tax bomb looks like.

The Base Case

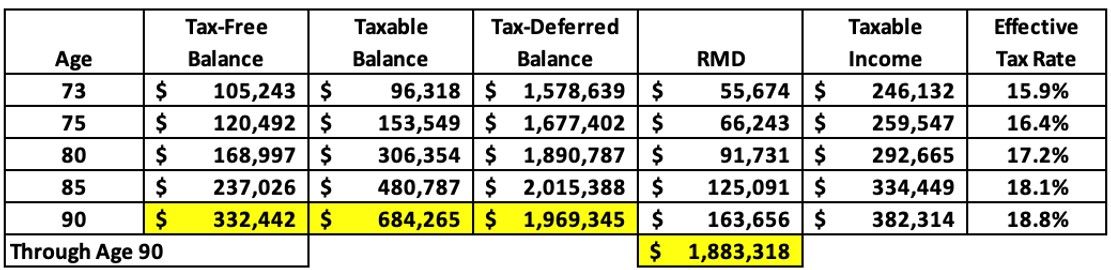

The table below shows a snapshot of their finances in retirement. Between their pension, Social Security income and the RMDs from their tax-deferred savings, they have high income throughout retirement, while staying in a reasonable tax bracket at least until age 85. However, toward the end of retirement, their RMDs have grown quite a bit, driving up their effective tax rate.

They are also projected to have $87,000 in Medicare means testing surcharges through age 90, which isn’t bad, but remember that you can think of these as avoidable taxes with proper planning.

By age 90, the couple is projected to leave $1.9 million in tax-deferred assets for their kids. The kids will have 10 years in which to completely drain the inherited IRA accounts, with all distributions being taxed as ordinary income at the kids’ marginal tax rate. That’s about $1.7 million less in inherited tax liability than the couple without the pension from the first bonus article. That makes sense, because much of their wealth is in the form of their pensions, which won’t pass to their kids.

Because their income from the pension, Social Security and RMDs exceeds their expenses, they reinvest some RMD income in most years, which helps the taxable account balance grow. The taxable accounts will receive a step-up in basis, so the kids won’t inherit a tax liability for those accounts. Meanwhile, they never need to touch the Roth accounts, so that tax-free money grows modestly for their kids.

The couple’s after-tax wealth at age 90 is $2.44 million, assuming taxable accounts have a 10% tax drag and tax-deferred accounts face a 24% federal and 0% state tax rates.

So, what do you think of their situation? They should enjoy a secure and comfortable retirement, and at least they remain in a reasonably low tax bracket throughout retirement. But could they meaningfully improve on their situation by implementing planning strategies like asset location and annual Roth conversions? Let’s see.

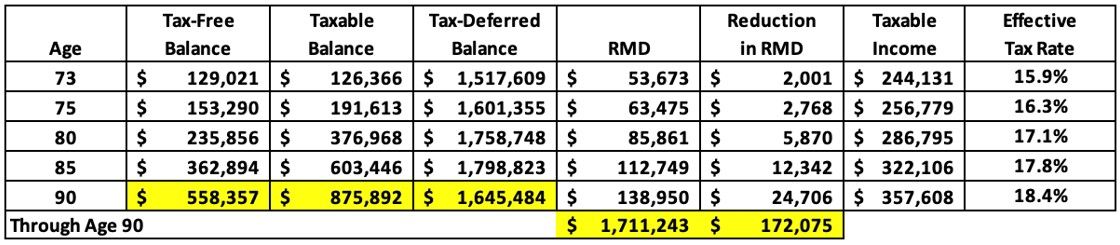

Scenario 1: Implement Asset Location

The first planning strategy I’ll examine is implementing asset location. Recall that asset location refers to placing asset classes with lower expected returns (think bonds and dividend stocks) in tax-deferred accounts to limit their growth, putting asset classes with higher expected returns (think small value and emerging market stocks) in Roth accounts so the tax-free money grows the fastest and putting asset classes that derive a lot of their growth from capital gains (think growth stocks) in taxable accounts.

By asset locating their assets, we expect to put 100% of their bonds in their tax-deferred accounts, which will earn a lower expected return of 4% rather than the 7% assumed in the base case. Initially, bonds make up 53% of their pre-tax allocation, which has an expected return of 6.3%. Over time, the bond allocation in the pre-tax accounts rises, reaching 71% at age 90, which means the expected return on the pre-tax accounts falls to 5.4%.

Meanwhile, the taxable and Roth accounts have a 100% stock allocation and a 9% expected return throughout retirement.

Let’s look at what that means throughout retirement.

- The couple’s taxable RMDs throughout retirement have fallen by $172,000, which reduces their effective tax rate slightly each year. Their annual tax savings is reduced by $480 at age 73, and increases throughout retirement, reaching $5,930 by age 90.

- The inherited tax liability from the tax-deferred accounts falls by $323,000.

- The taxable account balance that will pass to heirs with a step-up in basis rises by $191,000.

- The tax-free Roth balance that will pass to heirs rises by $226,000.

- Their Medicare means testing surcharges remain unchanged at $870,000.

- Their after-tax wealth at age 90 rises $152,000 to nearly $2.6 million.

Implementing asset location yields impressive benefits.

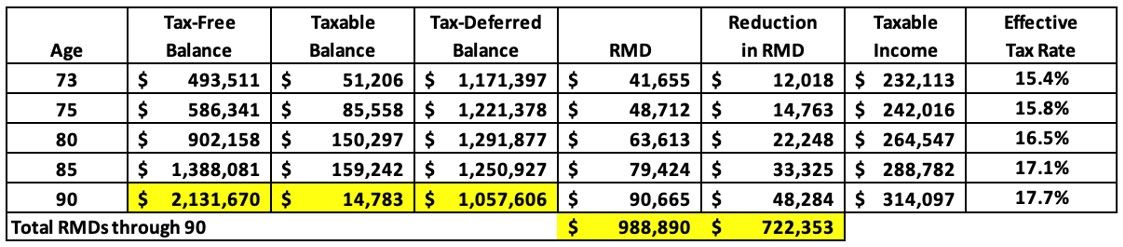

Scenario 2: Implement Asset Location and Annual Roth Conversions

Now let’s add annual Roth conversions to the strategy. Unfortunately for this couple, their pension income means they have less flexibility than the couple in the first bonus article to implement Roth conversions, because their higher income floor means they can’t do as much in Roth conversions without triggering Medicare means testing or bumping into a higher tax bracket. Recall that Medicare means testing starts at age 65 but is based on income from two years prior (two-year look-back) and that they plan to take Social Security at age 67.

While the couple from the first bonus article was able do Roth conversions of $975,000 early in retirement, this couple can convert only $40,000 a year from age 63 to 66 ($160,000 total) without triggering Medicare means testing.

Let’s look at the results compared to the asset location scenario. Even though the Roth conversions were relatively modest, they still have quite an impact because they happen early in retirement and earn a 9% return.

- The couple’s taxable RMDs throughout retirement fall an additional $722,000, which reduces their effective tax rate each year. Their annual tax savings is reduced an additional $2,800 at age 73, and the tax savings increases throughout retirement, reaching $10,400 by age 90.

- The inherited tax liability from the tax-deferred accounts falls an additional $588,000.

- The taxable account balance that will pass to heirs with a step-up in basis falls an additional $861,000. Why? Because the couple paid taxes on the Roth conversions using funds in the taxable account, and with smaller RMDs, the couple had less unneeded RMD income to reinvest each year into their taxable account.

- The tax-free Roth balance that will pass to heirs rises another $1.5 million!

- All $87,000 in Medicare means testing surcharges are eliminated.

- Their after-tax wealth at age 90 rises an additional $351,000 to $2.95 million.

Compared to the base case, implementing both the asset location and Roth conversion strategies reduces taxable RMDs by $722,000, Medicare means testing surcharges by $87,000 and the tax-deferred liability for heirs by $912,000. It increases tax-free Roth money for heirs by $1.8 million and after-tax wealth at age 90 by $504,000.

Some Closing Thoughts

Implementing some key planning strategies can have a profound impact throughout retirement on the taxes you pay and the tax liability your heirs will inherit.

While the couple with the pension has less flexibility in implementing Roth conversions, that strategy is still worth pursuing early in retirement because it significantly reduces taxes paid during retirement and transforms tax status of assets that pass to heirs.

Here are links to the previous articles in this series:

Part 1: Is Your Retirement Portfolio a Tax Bomb?

Part 2: When It Comes to Your RMDs, Be Very, Very Afraid!

Part 3: RMDs Can Trigger Massive Medicare Means Testing Surcharges

Part 4: Will Your Kids Inherit a Tax Bomb from You?

Part 5: How to Defuse a Retirement Tax Bomb, Starting With 1 Simple Move

Part 6: Using Asset Location to Defuse a Retirement Tax Bomb

Part 7: Roth Conversions Play Key Role in Defusing a Retirement Tax Bomb

Bonus article 1: 2 Ways Retirees Can Defuse a Tax Bomb (It’s Not Too Late!)

This article was written by and presents the views of our contributing adviser, not the Kiplinger editorial staff. You can check adviser records with the SEC (opens in new tab) or with FINRA (opens in new tab).

David McClellan is a partner with Forum Financial Management, (opens in new tab) LP, a Registered Investment Adviser that manages more than $7 billion in client assets. He is also VP and Head of Wealth Management Solutions at AiVante, a technology company that uses artificial intelligence to predict lifetime medical expenses. Previously David spent nearly 15 years in executive roles with Morningstar (where he designed retirement income planning software) and Pershing. David is based in Austin, Texas, but works with clients nationwide. His practice focuses on financial life coaching and retirement planning. He frequently helps clients assess and defuse retirement tax bombs.

-

-

To Afford Retirement, Take Inspiration from ‘The Golden Girls’

To Afford Retirement, Take Inspiration from ‘The Golden Girls’Roommates, a part-time job and renting out your vacation home could be ways to save early in retirement to cover more expensive years later on.

By Erin Wood, CFP®, CRPC®, FBSⓇ • Published

-

Why You Should Teach Your Kids Investing

Why You Should Teach Your Kids InvestingPutting money in the stock market is one of the best ways to build wealth in America. That's why it is so important for parents to teach their kids investing.

By Kyle Woodley • Published

-

To Afford Retirement, Take Inspiration from ‘The Golden Girls’

To Afford Retirement, Take Inspiration from ‘The Golden Girls’Roommates, a part-time job and renting out your vacation home could be ways to save early in retirement to cover more expensive years later on.

By Erin Wood, CFP®, CRPC®, FBSⓇ • Published

-

Career Transition? Three Steps to Protect Your Financial Health

Career Transition? Three Steps to Protect Your Financial HealthWhether you’ve been laid off or are moving on voluntarily, career transitions can be stressful, but there are ways to help tame the uncertainty.

By Krystal Barker Buissereth, CFA® • Published

-

Three Legal Documents Your Child Should Sign When They Turn 18

Three Legal Documents Your Child Should Sign When They Turn 18Legal documents such as durable power of attorney, a healthcare proxy and a HIPAA release can give parents the legal right to make decisions if their child needs help.

By Allen J. Falke, CPA, Esq., LL.M. • Published

-

Preparing for the Next Recession: Six Considerations for Retirees

Preparing for the Next Recession: Six Considerations for RetireesBeing more disciplined and risk averse in the good times can make it easier to weather the bad times when they inevitably arrive.

By Craig Kirsner, Investment Adviser Representative • Published

-

Finances Aside, What Does a Happy Retirement Look Like?

Finances Aside, What Does a Happy Retirement Look Like?Three examples of retirees show what it means to thrive in retirement. The common denominators provide clues on how to swing your own happy retirement.

By Dennis D. Coughlin, CFP, AIF • Published

-

Will You Pay Higher Taxes in Retirement?

Will You Pay Higher Taxes in Retirement?Your Social Security income and RMDs will most likely combine to deliver a tax torpedo, but there are ways to reduce your income in retirement to pay less tax.

By Joe F. Schmitz Jr., CFP®, ChFC® • Published

-

Inherited Retirement Plan? How to Easily Understand Payout Rules

Inherited Retirement Plan? How to Easily Understand Payout RulesFiguring out first which kind of beneficiary you are will make it easier to grasp the rules and timing on required distributions.

By Mike Piershale, ChFC • Published

-

For Financial Planning Success Now, Start by Looking at the Past

For Financial Planning Success Now, Start by Looking at the PastCertain beliefs could be impeding your financial planning, and learning what those are begins with exploring your money-related memories.

By Jamie P. Hopkins, Esq., CFP, RICP • Published