The Best REIT Stocks to Buy Now (or Hold)

The best REITs are an apt choice to buy and hold amid heightened inflation and recession fears.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

The past year has been a tough one for real estate investment trusts (REITs), with total returns (price + dividends) for the equity REIT sector lagging the broader S&P 500. But double-digit declines over the last year could set the stage for some of the best REITs to rally down the road.

Investment managers specializing in REIT stocks (opens in new tab) anticipate macro-conditions will remain challenging this year due to high interest rates, inflation and recession fears – not to mention tighter lending standards sparked by the collapse of several regional banks including Silicon Valley Bank.

Still, it's important to note that operating performances remain strong, creating the catalyst for a REIT recovery as fears abate and more certainty returns to capital markets.

Why should I buy REIT stocks?

REITs are likely to generate attractive income growth if the Federal Reserve can tame inflation and avoid a deep recession. (Here at Kiplinger, we have the odds of a recession happening this year at 50-50.)

Assuming a short-lived-recession scenario, real estate investment trusts would be able to capitalize on the demand for leasing space that exceeds new supply, which has been constrained by steeply rising material and labor costs. This supply-demand imbalance will give REITs strong rental pricing power for many property types.

Investment managers also think that the best stocks to buy among REITs are those continuing to benefit from secular tailwinds. These include self-storage, apartment, alternative housing, cell tower and industrial space operators. Net-lease REITs are also attractive because of their long-term leases that generate durable cash flows in every economic climate.

How we chose the best REITs

Having previously served as a director of investor relations for a New York Stock Exchange-listed REIT and having provided REIT coverage for Kiplinger over the last few years, I came up with this list of top real estate stocks by looking for names that have strong defensive characteristics and exceptional pricing power, including the ability to raise rent based on inflation. Additionally, the companies are well-prepared for high interest rates thanks to their effective cost controls and balance sheet management.

Additionally, we drilled down on some of the best dividend stocks in the REIT universe, with payouts that are well-covered by FFO (funds from operations, a key REIT earnings metric). Many of these names have generated a decade or more of steady dividend growth, while others are prepping for big dividend hikes this year.

Data is as of April 14. Dividend yields are calculated by annualizing the most recent payout and dividing by the share price.

Sun Communities

- Market value: $17.6 billion

- Dividend yield: 2.7%

Sun Communities (SUI (opens in new tab), $136.56) is America's leading owner/operator of manufactured housing, recreational vehicle (RV) parks and marinas. SUI's existing portfolio is made up of 353 manufactured housing communities, 182 RV parks and 134 marinas. Additionally, the REIT boasts a strong development pipeline consisting of 7,000 manufactured housing sites and 9,000 RV sites (opens in new tab). Sun Communities' portfolio occupancy levels are 96% in North America.

SUI is on this list of the best REITs to buy because it benefits from compelling supply-demand fundamentals for manufactured housing. Sun Communities received approximately 55,000 applications for sites in its housing communities last year. Manufactured housing is popular due to its ability to provide 25% more space than a typical multifamily rental at roughly half the cost per square foot.

The supply of manufactured housing is constrained, but Sun Communities has been able to leverage its land portfolio to add nearly 14,000 expansion and development sites since 2012. Supply-demand fundamentals are also compelling in the RV park sector. Approximately 9.5 million Americans plan to purchase an RV over the next five years and there are only about 1 million RV sites available nationwide for an estimated 11 million RV owners.

Once tenants join a Sun community, they rarely leave. Move-outs are less than 0.5% annually, while the average tenure for the REIT's manufacturing housing tenants is 14 years. RV park residents average eight-year tenures.

Accretive acquisitions helped the REIT deliver 12.9% core FFO per share gains in 2022.

Over the past decade, SUI has generated 9.2% core FFO per share growth, significantly outperforming the major REIT and broad-market indexes. Dividend growth has averaged 5.5% annually over five years and the payout is exceptionally conservative for a REIT at 47% of FFO.

Truist Securities (opens in new tab) analyst Anthony Hau (Buy) recently lowered the price target for SUI to $163 from $166, as well as his 2023 FFO estimate, citing "higher-than-expected operating expenses, particularly insurance." Still, the new price target represents implied upside of 19.4% to current levels.

Prologis

- Market value: $110.6 billion

- Dividend yield: 2.9%

Stifel (opens in new tab) analyst Stephen Manaker (Buy) recently reiterated a $140 price target for Prologis (PLD (opens in new tab), $119.76), representing implied upside of 16.9% to current levels. "We view Prologis as a growth story, with most of the growth from the current portfolio. The portfolio is global, although over 80% is in the U.S.," the analyst says. "We believe consensus underestimates the REIT's ability to convert its large loss-to-lease into revenue over the next few years. In addition, PLD is still well positioned to grow externally if opportunities arise."

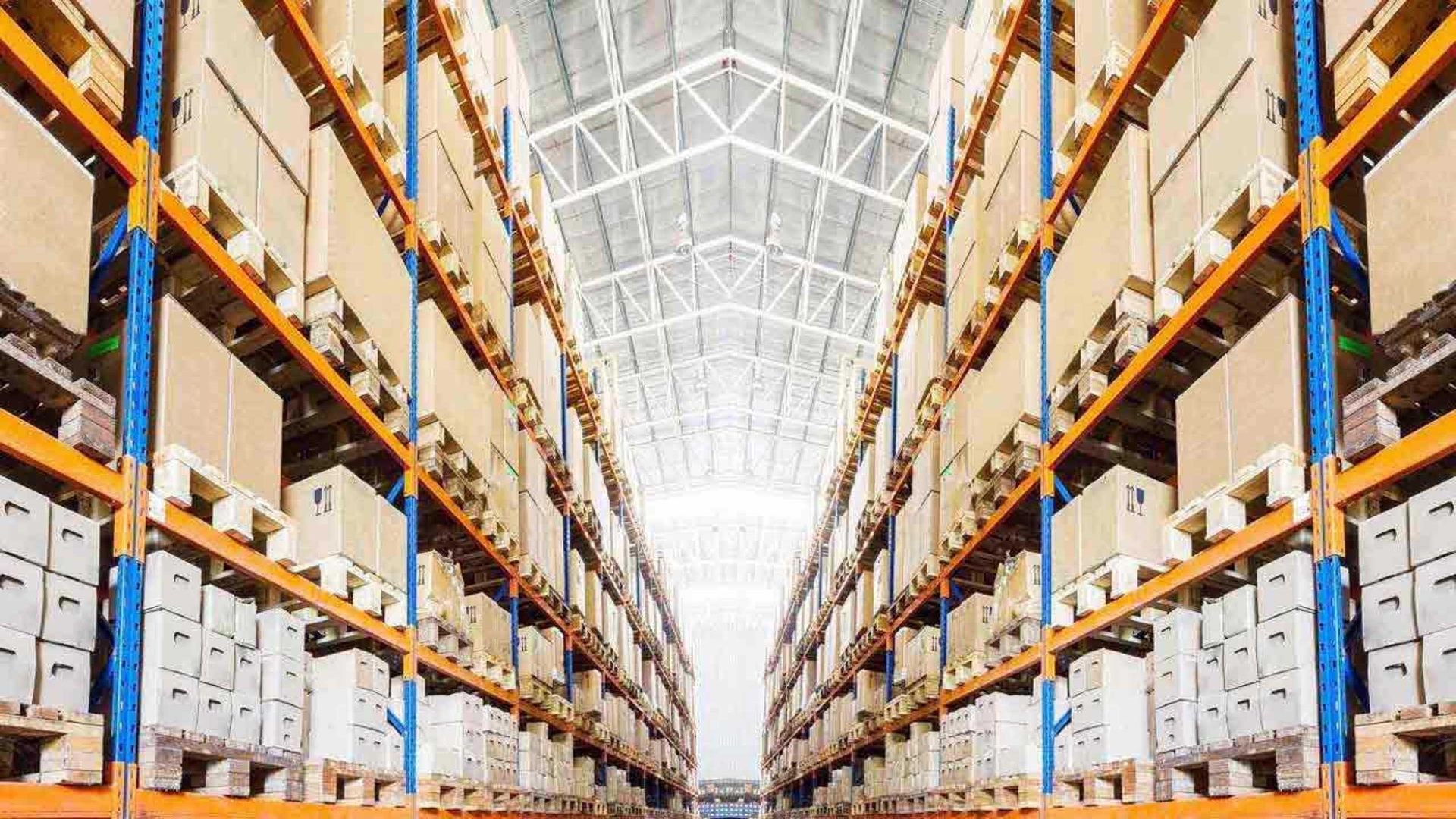

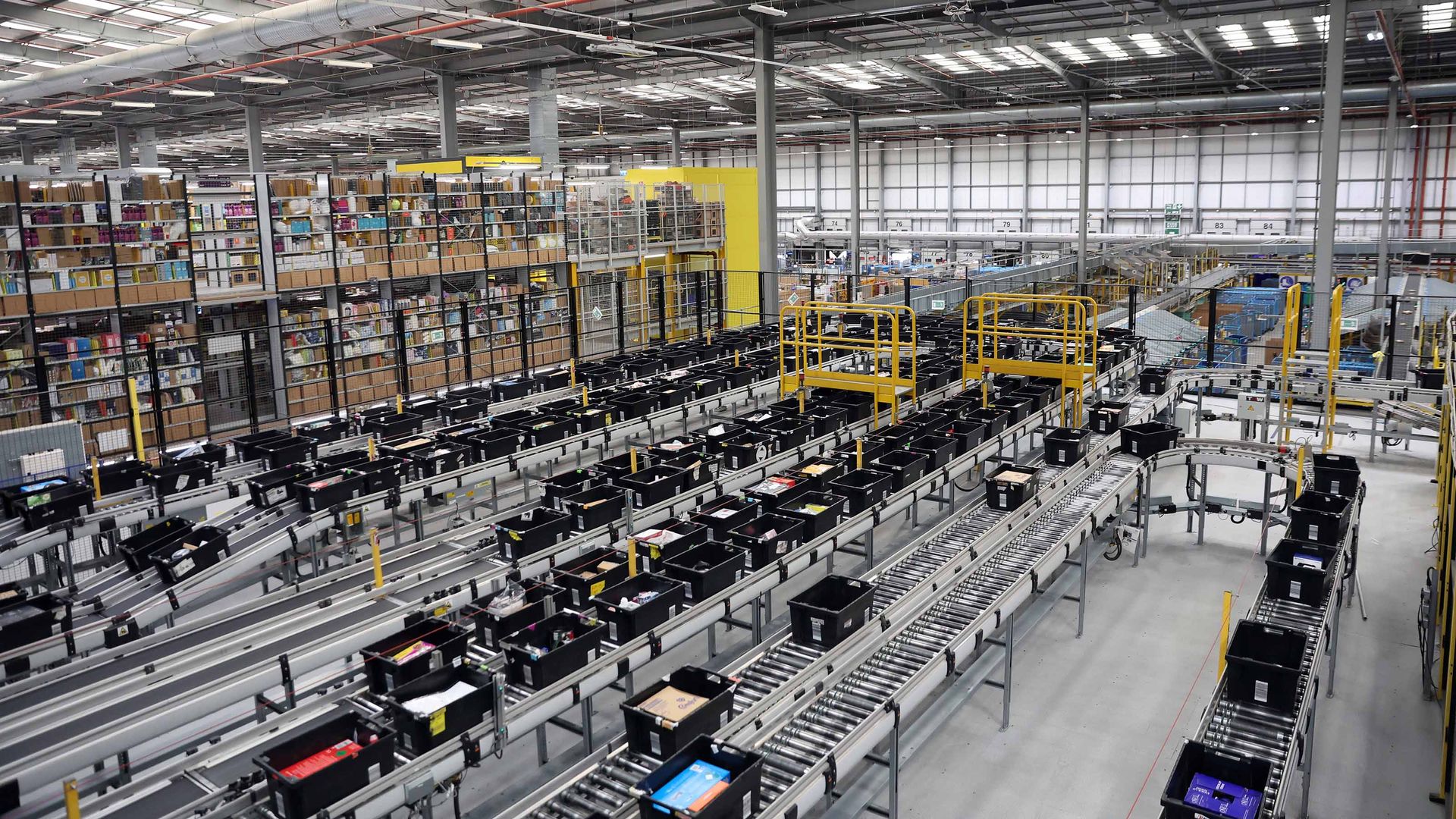

Prologis owns logistics real estate across the U.S., Europe and Asia; roughly 2.8% of global GDP flows through its distribution centers. Its portfolio is made up of warehouses representing 1.2 billion square feet of space leased to over 6,600 customers and is valued at $196 billion. Its customers are major logistics players like United Parcel Service (UPS (opens in new tab)) and DHL and e-commerce merchants like Amazon.com (AMZN (opens in new tab)) and Walmart (WMT (opens in new tab)). In addition to its existing facilities, the REIT owns a development-ready land portfolio that could add another 220 million square feet of new leasing space.

PLD is one of the best REITs to buy given its exceptional track record for creating value for investors. It does this in part through development activities and has generated over $11 billion of new value from $40 billion invested since 2001. Third-party facility management is another growth engine for the REIT. Earnings related to this business have risen 21% annually over five years.

The company's core FFO per share and dividend growth have exceeded REIT peer levels and the S&P 500 over the last three and five years. What's more, PLD's A credit rating and $12.7 billion of new investment capacity should fuel steady future growth.

Prologis has hiked dividends 12.5% annually over five years and keeps payout low at around 63% of FFO. This points to an exceptionally secure and rising dividend.

Public Storage

- Market value: $51.0 billion

- Dividend yield: 4.1%

Self-storage are some of the most recession-proof stocks among REITs. Other real estate suffered 25%-67% net losses during the Great Recession, but the self-storage segment grew profits 5%.

Public Storage (PSA (opens in new tab), $290.35) is the market leader in self-storage. The REIT has top market shares in 14 of the 15 largest U.S. markets and more than twice as many locations as its next largest competitor. It has interests in over 2,800 facilities and approximately 200 million square feet of rentable space and a presence in 40 U.S. states. Its top markets (Los Angeles, San Francisco, Miami, New York and Seattle) contribute approximately 40% of revenues.

The REIT has been aggressively building its franchise. Since 2019, Public Storage has expanded its portfolio by 23% and made over $7.0 billion of new investments. Profits have not taken a backseat to growth. PSA has achieved steady expansion in operating margins, which have grown through digital initiatives and reduced payroll and utility costs. As such, the company has emerged as the profit leader in the self-storage industry.

In 2022, the REIT's core FFO per share rose 26.1% year-over-year. Plus, annual contract rent per occupied square feet was up 15.3% on the year.

Public Storage has an A2 credit rating and one of the best balance sheets among REIT stocks. As for dividend growth, the REIT last August rewarded its investors with a $13.15 per share special dividend. And in February 2023, it hiked its quarterly dividend by 50%.

With operating cash flow exceeding $2.4 billion so far this year, total liquidity exceeding $1.0 billion and payout from FFO currently at 52%, Public Storage has plenty of dry powder to support dividend growth.

While the majority of covering analysts maintain a Buy or Strong Buy rating on PSA, Argus Research (opens in new tab) analyst Marie Ferguson has a Hold rating. "Demand for storage has suffered amid reduced consumer discretionary spending," Ferguson writes in a note to clients. "This has had a particularly strong impact on PSA, whose portfolio is heavily weighted toward states that can be hard hit by the economy, including California (18% of net rentable square feet), Texas (14%), and Florida (12%)."

American Tower

- Market value: $96.3 billion

- Dividend yield: 3.0%

One of the best inflation-proof investments is a stock whose dividend is rising faster than the consumer price index (CPI) (opens in new tab). Cell tower REIT American Tower (AMT (opens in new tab), $206.89) has done just that. This REIT's dividends have increased 20% annually since 2012, and analysts forecast 18% annual growth through 2025. AMT's dividend is also well covered, with FFO payout ranging around just 66%.

Over the past five years, AMT has generated robust gains in revenues (up 10% annually), EBITDA (up 10.4% per year) and adjusted FFO per share (rising 8.5% annually).

American Tower boasts a large, geographically diverse portfolio consisting of more than 225,000 cell tower sites across six continents. The company is a major beneficiary of 5G investments by major wireless carriers that lease space on the REIT's cell towers to build out their networks. Adding new tenants to current cell towers is extremely profitable for the company. Returns jump from 3% at one tenant per tower to 13% for two tenants and 24% for three tenants.

AMT's 2021 acquisition of data center REIT CoreSite strengthened its competitive position by enabling the company to offer its tenants a more vertically integrated infrastructure capable of supporting next-generation 5G networks.

American Tower maintains an investment-grade balance sheet and has substantially trimmed its debt since acquiring Coresite. The company ended the December quarter with $1.1 billion of cash, and $7.1 billion of total liquidity.

The REIT's December quarter property revenues rose 11.2% and adjusted EBITDA was up 12.6%. However, funds from operations was down 44.5% year-over-year due to forex headwinds, though adjusted FFO was up 15.1%. American Tower is guiding for a modest 1% gain in adjusted FFO this year.

Alexandria Real Estate Equities

- Market value: $24.7 billion

- Dividend yield: 4.1%

Alexandria Real Estate (ARE (opens in new tab), $118.47) is a life science REIT specializing in science, agricultural technology and technology office space located in the innovation centers of greater Boston, the San Francisco Bay area, New York, San Diego, Seattle and the Carolina Research Triangle.

The REIT's 1,000+ tenants consist of major global pharmaceutical and biotech companies, academic and government labs and life science device makers, all of which are recession-resistant. Alexandria Real Estate's portfolio consists of 75 million square feet of existing properties and 7.6 million in rentable square feet under construction. Over the next few quarters, ARE expects to add $655 million to net operating income from newly leased properties.

Robust demand for the REIT's life science properties is evidenced by the annual leasing volume of 8.4 million of rentable square feet in 2022, the second-highest in company history. Plus, 74% of that was generated from existing clients. ARE also posted same property net income growth of 9.6%, which was the highest annual growth in the company's history.

Alexandria Real Estate grew FFO per share by 8.5% in fiscal 2022, helped by new leasing activity.

We're not alone in our outlook that Alexandria Real Estate is one of the best REITs to buy in the new year. Investment bank UBS (opens in new tab) has ARE as one of its top stock ideas for this year, citing the REIT's strong balance sheet, well-covered dividend and best-in-class properties as factors.

Alexandria Real Estate is certainly not the cheapest REIT out there, currently trading at 16 times forward adjusted FFO. Still, ARE's dividend payout from FFO looks ultra-safe at 56% and dividend growth is attractive at 6.3% annually over five years.

Essex Property Trust

- Market value: $13.4 billion

- Dividend yield: 4.4%

Shares of apartment REIT Essex Property Trust (ESS (opens in new tab), $207.94) have taken a major beating over the last 12 months, down nearly 40% amid fears that a Silicon Valley employee exodus – not to mention massive tech layoffs – will hurt the REIT's primarily California Coast and Seattle-centric portfolio.

However, despite recent departures by some tech firms, the West Coast markets served by Essex Property Trust don't appear to be in jeopardy and continue to show above-average employment growth, higher-than-average household incomes and severely constrained housing supply. The REIT also continues to post 96% portfolio occupancy and steady double-digit same-property revenue growth.

ESS owns 252 apartment communities comprising 62,000 apartment units spread across eight major West Coast markets. The portfolio breakdown is 42% Southern California (Los Angeles, Orange County and San Diego), 40% Northern California (Oakland, Santa Clara and San Mateo) and 18% Seattle.

Thanks to its focus on profitable West Coast markets, Essex Property Trust has been able to produce core FFO per share growth twice the REIT industry average since 2007 and far superior dividend growth.

In addition, Essex Property Trust is poised to benefit from a new Google campus under construction (opens in new tab) in downtown San Jose that will create approximately 25,000 new jobs. The REIT has 10,000 apartment units located near the new campus.

Essex Property Trust's December quarter core FFO per share rose 16% and full-year core FFO guidance was up 16.2%.

In September, ESS shares were featured on Bank of America's list of stocks offering above-market and secure dividends. Indeed, the REIT is one of the best dividend stocks, a Dividend Aristocrat that has delivered 29 consecutive years of dividend growth. Over the past five years, Essex has grown its dividend by around 5% each year, on average, and payout is conservative at 60% of FFO.

Because of the brutal year-over-year selloff, investors have the chance to pick up one of the best REITs to buy at a major discount. The stock currently trades at just 16 times forward adjusted FFO.

STAG Industrial

- Market value: $5.8 billion

- Dividend yield: 4.5%

STAG Industrial (STAG (opens in new tab), $32.36) is a pure-play industrial warehouse REIT and a major beneficiary of e-commerce growth. Approximately 40% of its portfolio is e-commerce-related. As a percentage of U.S. retail sales, e-commerce has grown from roughly 6% seven years ago to 14.5% today and e-commerce penetration is expected to hit 30% by 2030.

STAG Industrial owns 562 warehouse properties encompassing 111.7 million square feet of leasing space across 41 states. Its tenants are primarily large, sophisticated public companies. Nearly 60% of its tenants are businesses generating more than $1 billion in annual revenues. While Amazon is STAG's single-largest tenant, accounting for 3% of annual rents, the portfolio is well-diversified both by geography, tenant and lease terms. Its holdings span more than 60 markets and more than 45 industries.

The REIT's cash flows are reliable, with less than one-quarter of its leases expiring through 2024. The $1 trillion U.S. industrial real estate market also provides STAG Industrial with plenty of growth opportunities. The REIT's acquisition pipeline is valued at $2.4 billion, but STAG is very selective in what it acquires.

During the December quarter, STAG grew core FFO per share by 7.8% and maintained a 98.5% portfolio occupancy rate.

In addition to being one of the best REITs to buy, STAG is also one of the best monthly dividend stocks and has hiked payments every year since 2011. Dividend growth has been modest at just 0.7% annually over five years, but management has shared plans to grow future dividends in line with CAD (cash available for distribution). Boosting the dividend in line with CAD would suggest 4% annual hikes in the future.

STAG shares are down a remarkable 18% year-over-year to trade at just 14 times forward FFO.

National Retail Properties

- Market value: $7.8 billion

- Dividend yield: 5.2%

Investors who have "stocks with reliably growing dividends" on their wish list should consider shares of National Retail Properties (NNN (opens in new tab), $42.54). The owner of single-tenant, net-leased retail properties has delivered 33 consecutive dividend increases. NNN owns more than 3,400 properties encompassing 35.0 million square feet of leasing space, with assets valued at $8.1 billion.

National Retail Properties manages a well-diversified, recession-resistant portfolio consisting of convenience stores (16.5% of the portfolio), automotive service locations (13.7%), and full and limited-service restaurants (18.0%) such as Taco Bell, Wendy's and Denny's. Its sites are leased to more than 400 tenants nationwide.

The REIT's leases provide reliable cash flow secured by average remaining lease terms of 10.4 years. Additionally, NNN's portfolio has a 99.4% occupancy rate. National Retail Properties also offers an investment-grade balance sheet, no significant debt maturities before 2024 and great liquidity with over $930 million of borrowing capacity available. The dividend payout is maintained at a conservative 67% of adjusted FFO.

It's not only reliable dividends that make NNN one of the best REITs to buy and hold. National Retail Properties has generated respectable 4.3% annual gains in core FFO since 2016 and annual shareholder returns averaging 11.5% over 30 years.

The REIT's December quarter results beat consensus analyst estimates, with core FFO per share up 9.9%. Acquisitions, high occupancy and rent collection performances bolstered financial results.

NNN shares appear reasonably priced, trading at 13 times forward adjusted FFO – a nearly 8% discount to similar real estate stocks.

W.P. Carey

- Market value: $15.0 billion

- Dividend yield: 6.0%

With an enterprise value of approximately $23 billion, W.P. Carey (WPC (opens in new tab), $71.84) ranks as one of the world's largest net-lease REITs. WPC invests in single-tenant, net lease industrial, warehouse, office, retail and self-storage properties that have long-term net leases and built-in rent escalators. The REIT's assets are located in the US and Europe.

At present, W.P. Carey's portfolio consists of 1,449 properties leased to 392 tenants, encompassing 176 million square feet of leasing space. The portfolio breakdown by property type is dominated by industrial (27%) and warehouse (24%), with smaller concentrations of office (17%), retail (17%) and self-storage (4%). Top tenants include U-Haul, the Spanish government, German retailer Hellweg and Extra Space Storage (EXR (opens in new tab)).

WPC's portfolio boasts a 98.8% occupancy rate and a weighted average remaining lease term of 10.8 years. Approximately 55% of the REIT's leases have contractual rent escalators linked to CPI and another 40% of leases have fixed escalators.

W.P. Carey delivered 5.2% adjusted FFO per share gains in 2022. The REIT ended the December quarter with $2.2 billion of liquidity, and received a ratings upgrade from S&P in January.

WPC is another of the best REITs to buy for reliable dividend growth. The company has increased its dividend every year since going public in 1998 and has maintained a stable payout since converting to a REIT in 2012. Payout from adjusted FFO currently ranges around 68%.

WPC is currently valued at roughly 13 times forward adjusted FFO, a roughly 8% discount to its industry peers. Plus, its dividend yield of 6.0% is the highest among all the REITs featured here.

Lisa currently serves as an equity research analyst for Singular Research covering small-cap healthcare, medical device and broadcast media stocks.

-

-

To Afford Retirement, Take Inspiration from ‘The Golden Girls’

To Afford Retirement, Take Inspiration from ‘The Golden Girls’Roommates, a part-time job and renting out your vacation home could be ways to save early in retirement to cover more expensive years later on.

By Erin Wood, CFP®, CRPC®, FBSⓇ • Published

-

Why You Should Teach Your Kids Investing

Why You Should Teach Your Kids InvestingPutting money in the stock market is one of the best ways to build wealth in America. That's why it is so important for parents to teach their kids investing.

By Kyle Woodley • Published

-

International Stocks: Time to Explore Investments Abroad

International Stocks: Time to Explore Investments AbroadIt's time for American investors to pack up their stay-at-home strategy and go shopping abroad for international stocks.

By Nellie S. Huang • Published

-

Investors Nearing Retirement Show Patience With Markets

Investors Nearing Retirement Show Patience With MarketsDespite last year’s upheaval, many investors are sticking with long-term plans and tightening their budgets instead of moving money out of stocks and bonds.

By Matthew Sommer, Ph.D. CFA® • Published

-

Stock Market Today: Stocks Fall After First Republic Bank Suspends Dividend

Stock Market Today: Stocks Fall After First Republic Bank Suspends DividendThe embattled lender's dividend cut was just the latest sign of instability in the banking industry.

By Karee Venema • Published

-

Best Consumer Discretionary Stocks to Buy Now

Best Consumer Discretionary Stocks to Buy NowConsumer discretionary stocks have been challenging places to invest in, but these picks could overcome several sector headwinds.

By Will Ashworth • Published

-

Stock Market Today: Stocks Rally on Credit Suisse, First Republic Bank Rescue News

Stock Market Today: Stocks Rally on Credit Suisse, First Republic Bank Rescue NewsReports that major U.S. banks would step in to help First Republic Bank helped stocks swing higher Thursday.

By Karee Venema • Published

-

Stock Market Today: Stocks Struggle on Credit Suisse, First Republic Bank Concerns

Stock Market Today: Stocks Struggle on Credit Suisse, First Republic Bank ConcernsChaos in the financial sector stole the spotlight from this morning's inflation and retail sales updates.

By Karee Venema • Published

-

What the Markets’ New Tailwinds Could Look Like in 2023

What the Markets’ New Tailwinds Could Look Like in 2023Historically, the markets bounce back nicely after sharp declines, so focusing on historically high-quality companies trading at today’s lower valuations could be a good recovery strategy.

By Don Calcagni, CFP® • Published

-

Stock Market Today: Nasdaq Gains as Treasury Yields Collapse

Stock Market Today: Nasdaq Gains as Treasury Yields CollapseThe tech-heavy index swung higher Monday as investors sought out safety in government bonds.

By Karee Venema • Published