Apple Launches New Savings Account: What to Know

If you're an Apple Card user, you could be earning a high yield on your cash.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

Apple launched a new savings account on Monday, and it offers a rate of more than 10 times the national average.

"Savings helps our users get even more value out of their favorite Apple Card benefit — Daily Cash — while providing them with an easy way to save money every day,” Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet (opens in new tab), said in a press release.

The account offers an impressive rate of 4.15%. For comparison, the current national average APY on savings accounts is only 0.39%, according to the FDIC, although since last year, rates for high-yield savings accounts have shot up, and many of the top high-yield accounts now offer savings rates of over 4%.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Federal Reserve has been continually hiking interest rates over the last year in an attempt to ease high inflation rates. As a result, customers realize higher commercial interest rates, and in turn spending goes down. The silver lining to this is that in many cases, when interest rates rise, so do savings rates.

By using our new tool, in partnership with Bankrate, you can compare current savings rates below.

Apple Card Savings Account

In order to open Apple’s new savings account and take advantage of its high savings rate, you’ll need to have an Apple Card. An Apple Card is Apple’s own credit card, offering 3% daily cash on Apple purchases as well as on purchases from select merchants when using your Apple Card or Apple Pay. Plus, you’ll get 2% daily cash on any other purchases made with your Apple Card or Apple Pay, and the card is free of any fees.

Apple's savings account, from Goldman Sachs, offers a high-yield APY of 4.15%. The account has no fees, no minimum balance requirements and no minimum deposit. With this account, Apple hopes to offer a “seamless” approach to managing your money.

Bailey states (opens in new tab), “Our goal is to build tools that help users lead healthier financial lives, and building Savings into Apple Card in Wallet enables them to spend, send, and save Daily Cash directly and seamlessly — all from one place.”

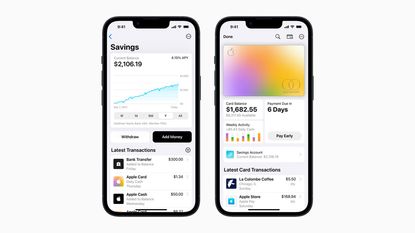

Users can set up and access the savings account with an easy-to-use dashboard in Wallet. From there, users can keep track of interest earned, check their account balance and deposit cash or make withdrawals to a linked bank account or Apple card. After setting up a savings account, any daily cash earned from your Apple Card will be deposited automatically into your account.

Related Content

Erin pairs personal experience with research and is passionate about sharing personal finance advice with others. Previously, she was a freelancer focusing on the credit card side of finance, but has branched out since then to cover other aspects of personal finance. Erin is well-versed in traditional media with reporting, interviewing and research, as well as using graphic design and video and audio storytelling to share with her readers.

-

-

Consumers Won't Cut Mobile, Internet Spending, Despite Inflation: Kiplinger Economic Forecasts

Consumers Won't Cut Mobile, Internet Spending, Despite Inflation: Kiplinger Economic ForecastsEconomic Forecasts Consumers Won't Cut Back on Mobile or Internet Spending, Despite Inflation: Kiplinger Economic Forecasts

By John Miley • Published

-

Courts to Rule on Agency Powers: Kiplinger Economic Forecasts

Courts to Rule on Agency Powers: Kiplinger Economic ForecastsEconomic Forecasts The scope of agency power is under the spotlight in cases in the Supreme and Federal Courts: Kiplinger Economic Forecasts

By Letter Editors • Published