3 Sustainable Fashion Stocks to Buy Now

The apparel industry has a rough record on environmental, social and governance issues, but these firms are trying harder.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

The fashion industry faces many sustainability challenges, and it has been financially sucker-punched by COVID lockdowns in China and surging inflation. So investors with environmental, social and corporate governance issues in mind face a host of hurdles when it comes to trying on fashion stocks. But we found a handful of companies that stand to outperform the industry on both financial and ESG measures.

Apparel makers have long come under fire for being environmentally unsound. A 2020 report (opens in new tab) by McKinsey & Co. and the Global Fashion Agenda, a nonprofit group dedicated to improving sustainability in the apparel industry, found that the industry was responsible for about 4% of global greenhouse gas emissions in 2018. That amount is on par with the annual emissions of France, Germany and the U.K. combined. Moreover, much of the industry hews to the “fast fashion” business model, which designs and markets styles in rapid cycles to increase consumption and demand. As a result, any improvements made in fashion sustainability may be erased quickly by growing consumption.

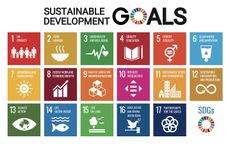

Some apparel companies have committed to achieving net-zero emissions by 2050 using transparent, evidence-based measures as part of a United Nations initiative to coordinate the fashion industry’s sustainability efforts. But Lindita Xhaferi-Salihu, who leads the UN project, thinks regulation is needed to bring the full industry on board.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Managing climate risk isn’t the fashion industry’s only challenge. Labor and human rights issues are also tricky. The industry has a deep and complex supply chain. Most garment companies rely heavily on supply-chain workers in Southeast Asia, where human trafficking, violence and safety lapses abound, despite some improvements after a 2013 Bangladesh factory collapse killed more than 1,100 garment workers.

Change is Coming

Regulatory change on many levels may spur the fashion industry forward on sustainability. The Securities and Exchange Commission is moving closer to requiring clothing companies to disclose greenhouse gas emissions that occur all along their supply chains. New York is working on a fashion sustainability law requiring firms with more than $100 million in operating profit and a presence in New York—where most U.S. fashion companies are based—to comply with climate change disclosures. On the employment front, earlier this year California passed the Garment Workers Protection Act, which requires that workers be paid by the hour instead of by the piece of clothing made. A similar bill has been proposed at the federal level. Many garment workers in the U.S. are paid by the piece instead of by the hour, earning well below minimum wage.

In short, the fashion industry faces myriad ESG challenges, as well as financial tests, with inflation and the possibility that a recession is on the way. These three companies are up to the task. All returns and data are through July 8.

Deckers Outdoor (DECK (opens in new tab)) produces iconic footwear, including Uggs and Teva. Like most fashion firms, Deckers uses a mountain of resources to make its shoes and clothing. But the firm is vigilant about tracking and lowering its consumption. For example, it takes 1,885 gallons of water to manufacture and package one pair of Uggs—or roughly 11% less water than it takes for the average leather shoe. And the Uggs brand is on track to cut its water use by 30% by 2030. That’s partly why Deckers has earned a “leader” rating from The Textile Exchange, a nonprofit group that rates company commitments to source sustainable and responsible raw materials.

Since 2014, Deckers has issued an annual report (opens in new tab) that examines the firm’s environmental footprint—“from farm to foot”—including inputs such as water and outputs such as emissions and waste. The firm sets a number of earth-friendly targets it wants to achieve and reports its year-by-year progress for each one. In its report for fiscal year 2021, which ended in May, Deckers said it was on track to use only repurposed wool (no virgin wool) for its footwear by 2022; last year, 98.7% of wool used in its footwear was repurposed. That level of management and disclosure is far greater than the average shoe company offers.

Meanwhile, business is humming. Deckers recently reported robust growth in sales across all of its brands over the past fiscal year. The company has a healthy balance sheet with no long-term debt, too. CFRA rates Deckers a “buy” and has a 12-month price target of $350 for the stock. A consensus of Wall Street analysts is even more bullish, with a price target of $397.

PVH Corp (PVH (opens in new tab)), which owns the Calvin Klein and Tommy Hilfiger brands, has emerged as a leader in promoting good labor practices along its supply chain. The company places third among 37 industry peers in the KnowTheChain (opens in new tab) benchmark, which rates clothing firms for labor conditions.

PVH has done a good job of addressing worker grievances and boosting supply-chain transparency. It signed the International Accord for Health and Safety in the Textile and Garment Industry, and the company has earned a near-perfect score for its Bangladesh operations; last year, it relied on 11 Bangladeshi suppliers, most with more than 1,000 workers. And ESG-rating company Refinitiv places the company fifth-best overall out of 118 apparel and textile companies, thanks to high scores on human rights, governance and sustainability.

The company spent the pandemic getting its balance sheet in order, reducing debt and building cash reserves. It reinstituted its $0.0375 quarterly dividend in late 2021 and plans to repurchase $1 billion in shares through 2026. And the stock is cheap. Shares recently traded at six times expected earnings for the year ahead, half the average price-earnings ratio of its peer group, according to Zacks Investment Research. CFRA analyst Zachary Warring rates the stock a “buy” and has a 12-month target price of $100.

Tapestry (TPR (opens in new tab)) owns the brands Coach, Kate Spade and Stuart Weitzman, which boast broad international appeal and strong sales. The firm’s overall ESG score from Refinitiv ranks a so-so 35 out of 276 specialty retail companies, largely because it lags in supply-chain labor issues. But chief executive Joanne Crevoiserat, who arrived in 2020, has reenergized the firm’s ESG strategy.

Among the new initiatives: By 2025, Tapestry will use 100% renewable energy to power its stores, offices and procurement centers. It aims to reach 500,000 factory workers with programs that address “health, financial inclusion and gender equality.” And it will link 10% of executive bonuses to performance on diversity, equity and inclusion goals.

Argus analyst Kristina Ruggeri rates the stock a “buy.” The company’s focus on data analytics and customer engagement has improved sales outside of China. Still, COVID lockdowns in China, its biggest market outside of North America, have hit Tapestry hard. As a result, Argus recently lowered its price target from $54 to $40.

Ellen writes on environmental, social and governance (ESG) investing and sustainability. She was an ESG manager and analyst at Calvert Investments for 15 years, focusing on climate change and consumer staples. She served on the sustainability councils of several Fortune 500 companies, led corporate engagements, and filed shareholder proposals.

Prior to joining Calvert, Ellen was a program officer for Winrock International, managing loans to alternative energy projects in Latin America. She earned a master’s from University of California in international relations and Latin America. She is fluent in Spanish and Portuguese.

-

-

To Afford Retirement, Take Inspiration from ‘The Golden Girls’

To Afford Retirement, Take Inspiration from ‘The Golden Girls’Roommates, a part-time job and renting out your vacation home could be ways to save early in retirement to cover more expensive years later on.

By Erin Wood, CFP®, CRPC®, FBSⓇ • Published

-

Why You Should Teach Your Kids Investing

Why You Should Teach Your Kids InvestingPutting money in the stock market is one of the best ways to build wealth in America. That's why it is so important for parents to teach their kids investing.

By Kyle Woodley • Published

-

Stock Market Holidays in 2023: NYSE, NASDAQ and Wall Street Holidays

Stock Market Holidays in 2023: NYSE, NASDAQ and Wall Street HolidaysMarkets When are the stock market holidays? Take a look at which days the NYSE, Nasdaq and bond markets are off in 2023.

By Kyle Woodley • Last updated

-

Stock Market Trading Hours: What Time Is the Stock Market Open Today?

Stock Market Trading Hours: What Time Is the Stock Market Open Today?Markets When does the market open? While it's true the stock market does have regular hours, trading doesn't stop when the major exchanges close.

By Michael DeSenne • Last updated

-

Bogleheads Stay the Course

Bogleheads Stay the CourseBears and market volatility don’t scare these die-hard Vanguard investors.

By Kim Clark • Published

-

I-Bond Rate Is 6.89% for Next Six Months

I-Bond Rate Is 6.89% for Next Six MonthsInvesting for Income If you missed out on the opportunity to buy I-bonds at their recent high, don’t despair. The new rate is still good, and even has a little sweetener built in.

By David Muhlbaum • Last updated

-

What Are I-Bonds?

What Are I-Bonds?savings bonds Inflation has made Series I savings bonds enormously popular with risk-averse investors. How do they work?

By Lisa Gerstner • Last updated

-

This New Sustainable ETF’s Pitch? Give Back Profits.

This New Sustainable ETF’s Pitch? Give Back Profits.investing Newday’s ETF partners with UNICEF and other groups.

By Ellen Kennedy • Published

-

As the Market Falls, New Retirees Need a Plan

As the Market Falls, New Retirees Need a Planretirement If you’re in the early stages of your retirement, you’re likely in a rough spot watching your portfolio shrink. We have some strategies to make the best of things.

By David Rodeck • Published

-

Where the Midterm Election Races Stand Today

Where the Midterm Election Races Stand TodayEconomic Forecasts In a tight race, these state elections may make the difference when midterm results are announced in November.

By Sean Lengell • Published